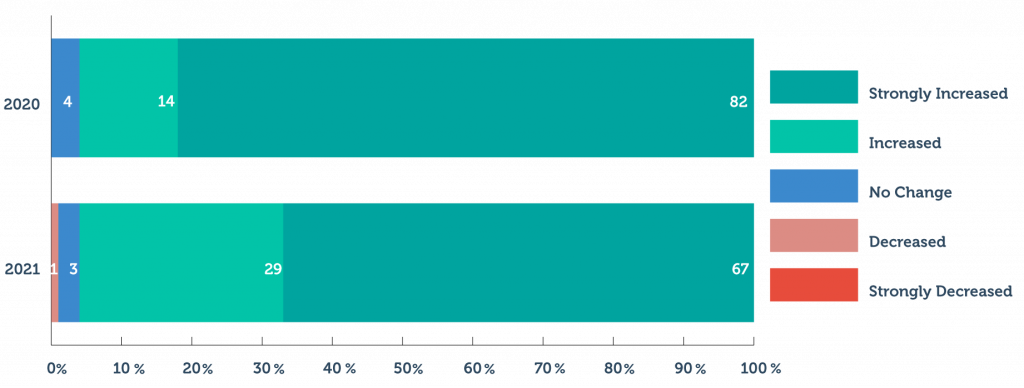

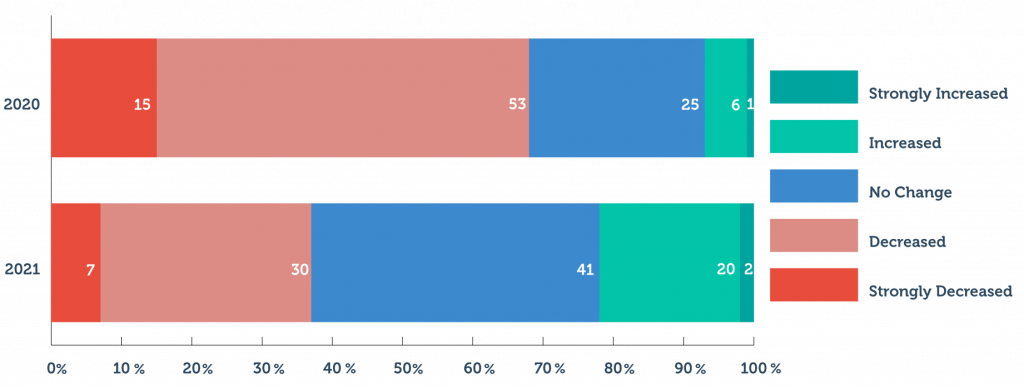

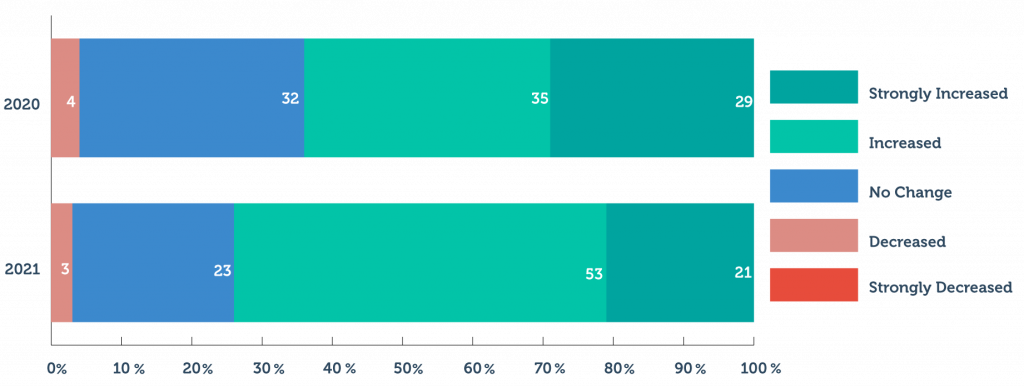

ROI vs. VOI: The Benefits of Employee Wellness Programs

Explore the implications of well-being perks in the workplace by comparing ROI vs. VOI, the effectiveness of these two metrics, and which is better for measuring the benefits of employee wellness programs.