Key Elements of Successful Employee Wellness Programs

Despite widespread adoption and recognized benefits, why does skepticism still cloud the effectiveness of employee wellness programs?

Shortlister surveyed more than 125 of the nation’s top benefit consultants to better understand the current wellness landscape. These consultants represent thousands of major companies across the United States – businesses that cover millions of lives in total.

This survey was intended to give a snapshot of the ever-changing employee wellness space: what wellness areas companies are investing in, where consultants expect companies to invest in the upcoming year, and technology changes within wellness platforms.

Of course, 2020 brought far more turbulence than a typical year, and with that change came new obstacles. Consultants were also surveyed about the impact the COVID-19 pandemic had on the employee wellness market, as well as how diversity, equity, and inclusion (DEI) efforts are being considered within wellness.

Note: Our previous edition of this report was published in 2019; with the drastic and rapid changes of 2020 we delayed surveying brokers to get a better snapshot of how the market has settled. Surveys were distributed and answered in late 2020.

Employee benefits consultants, as well as HR and procurement teams, can use the aggregated survey response data to better understand buyer trends in the wellness and benefits space, and to see where other companies are allocating their benefits budgets.

N=140 benefits consultant respondents

The Workplace Wellness Trends report has taken an annual snapshot of the wellness market for the past five years.

With its data we can see shifts within the established market as well as traction with new trends.

Overall, this series of questions helps shed light on the thinking of major benefits consultants, and the businesses they represent, when it comes to the wellness market: their opinions on wellness programs overall, the most critical elements of a modern wellness offering, and their preferences on how a wellness program should be delivered.

The survey identified 27 individual solutions that make up overall well-being strategies for employers. It asked respondents to rate three solutions as a “Must Have” component of a well-being strategy, three solutions as having “Growing Demand,” and three solutions as having “Declining Demand.”

The COVID-19 pandemic exacerbated ongoing shifts in the wellness market away from on-site testing. In 2018 and 2019, brokers had differing opinions of Biometrics and Health Risk Assessments (HRAs): They were each simultaneously a top-three “Must Have” program and a top-three “Declining Demand” program. This indicated a divergence in the market for those products. The pandemic and the subsequent lockdowns and work-from-home environments immediately and drastically decreased the demand for these services, and they were deemed the two programs most seen as having Declining Demand.

Even prior to the pandemic, Financial Wellness and Mental Well-Being programs were ranked as programs most seeing “Growing Demand.” Demand continued to grow for these programs as employees experienced lockdowns, isolation, and personal loss, and the country saw record-high unemployment rates.

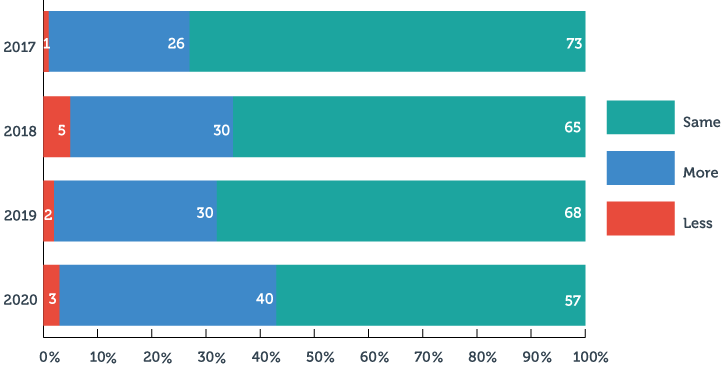

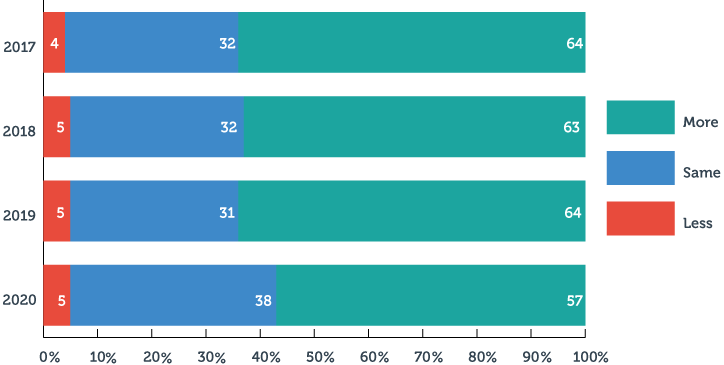

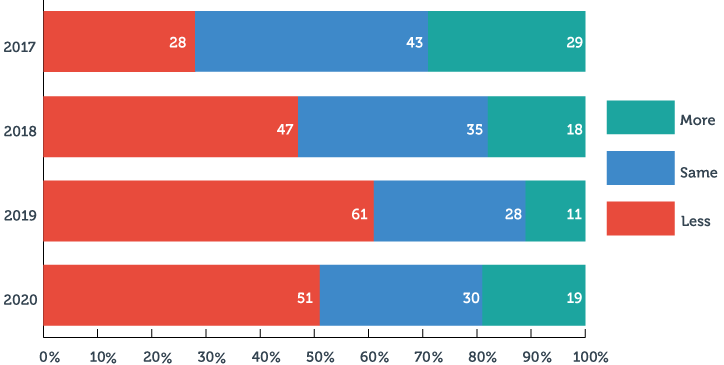

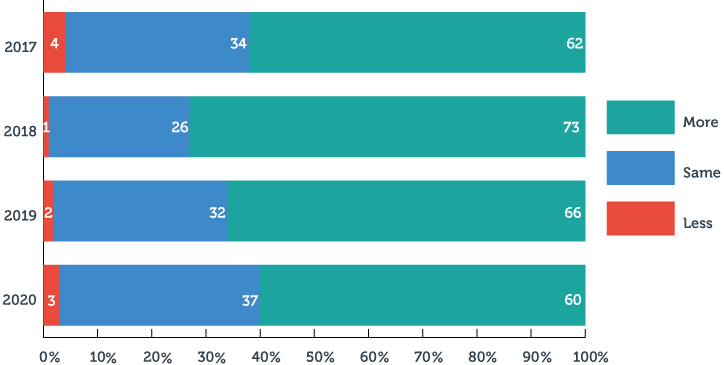

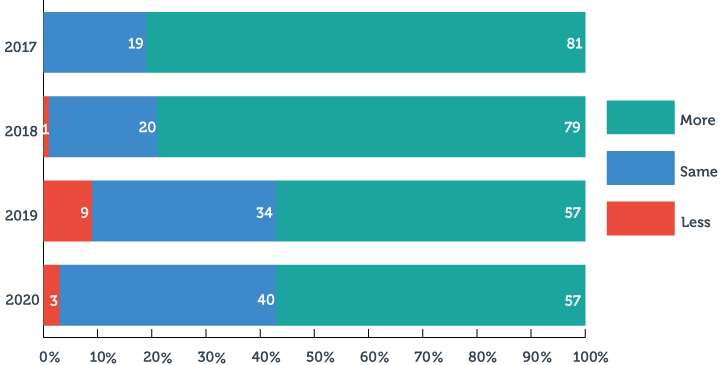

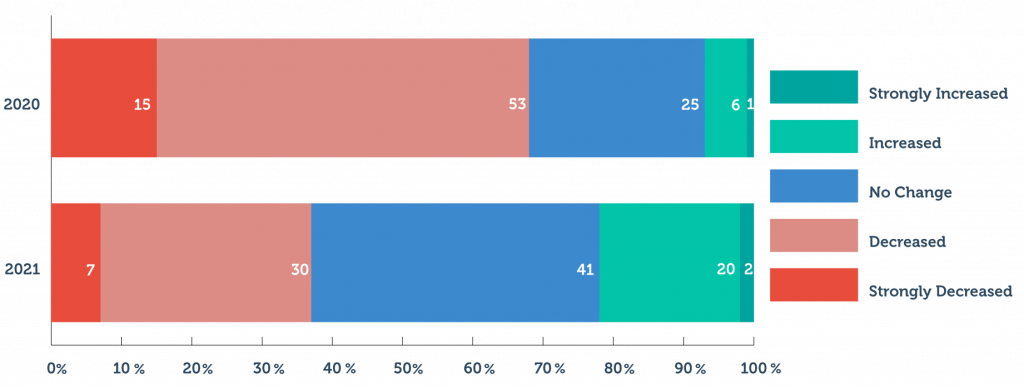

The survey asked respondents eight high-level questions to better understand the purchasing trends of employers and how they are prioritizing workplace well-being overall. For each question we asked if a consultant’s clients are doing “More,” “Less,” or the “Same” of a behavior.

Overall, the majority of respondents say clients are prioritizing wellness as a business objective more than in the past. Mobile apps (and mobile access) are a priority, as are platform or hub technologies that act as the “front door” for employees to access all benefit related information and resources.

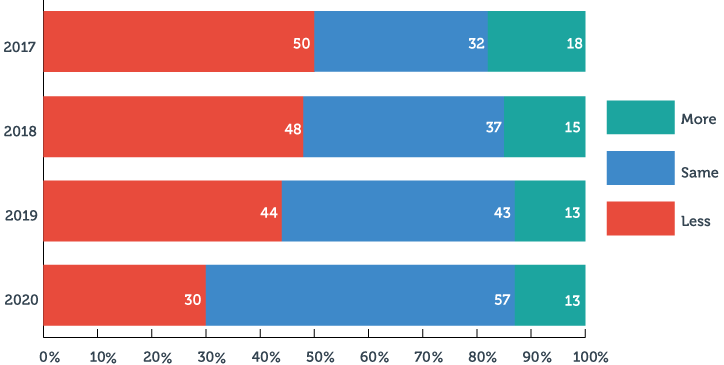

On the other side, outcomes-based wellness initiatives are on the decline.

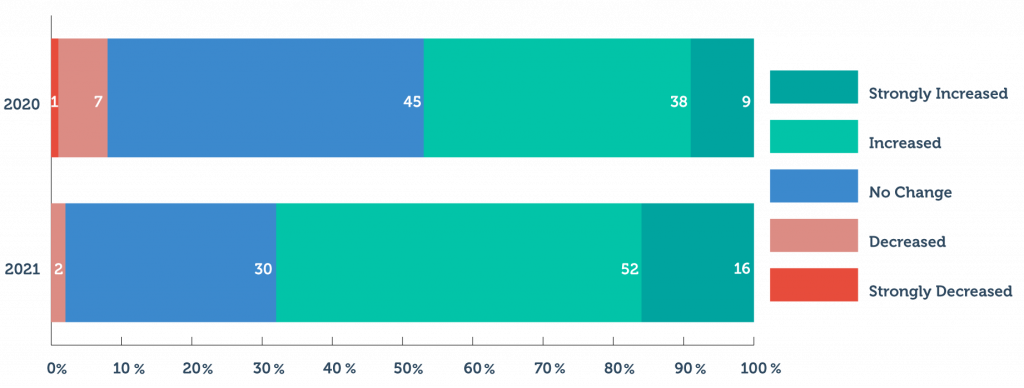

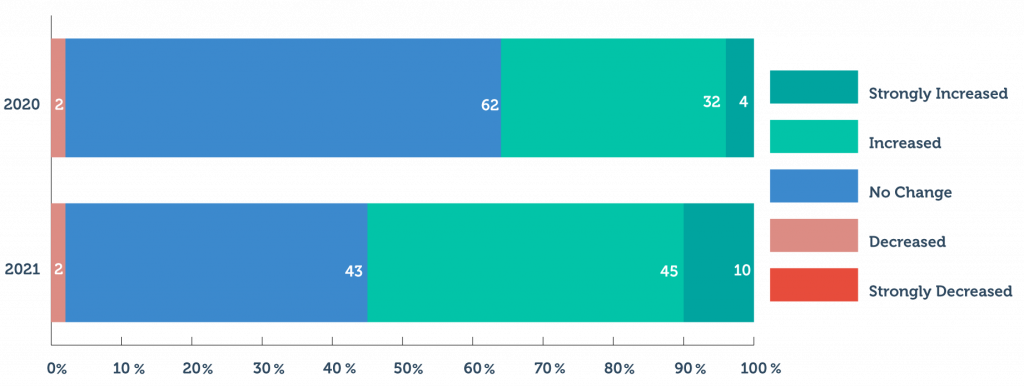

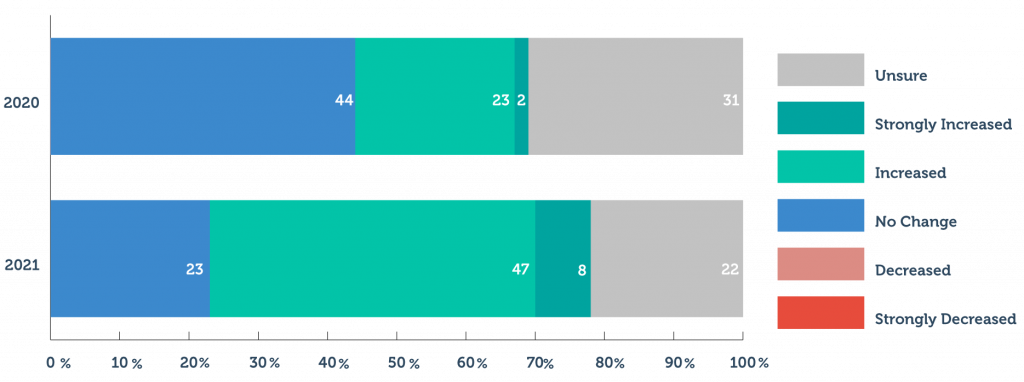

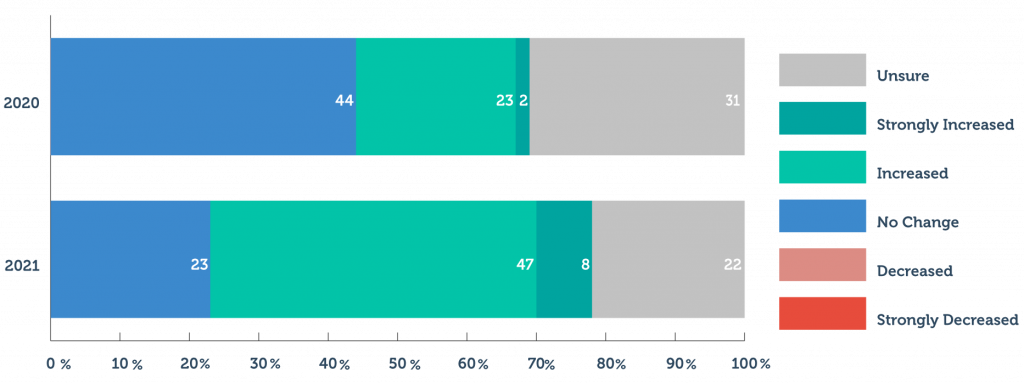

In every edition of this prospectus, respondents said that their clients placed a higher priority on wellness as a business objective than they did in the previous year. As employee wellness prioritization becomes the norm, this growth has tapered since 2017, with a higher share of respondents indicating that wellness prioritization remains the same. Still, just three percent of respondents said wellness prioritization declined year-over-year from their clients.

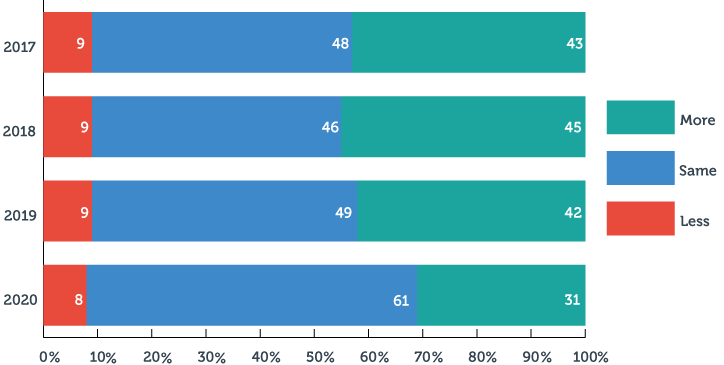

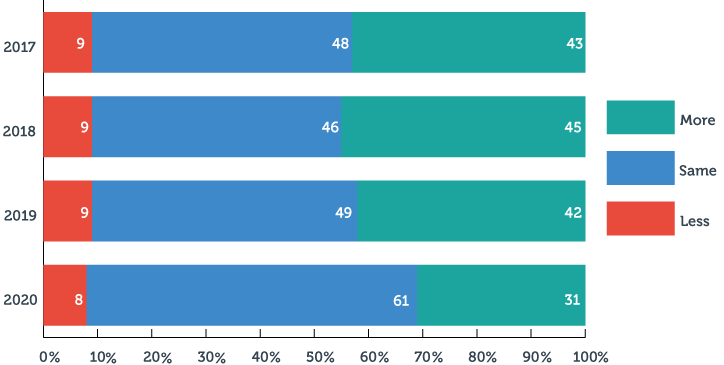

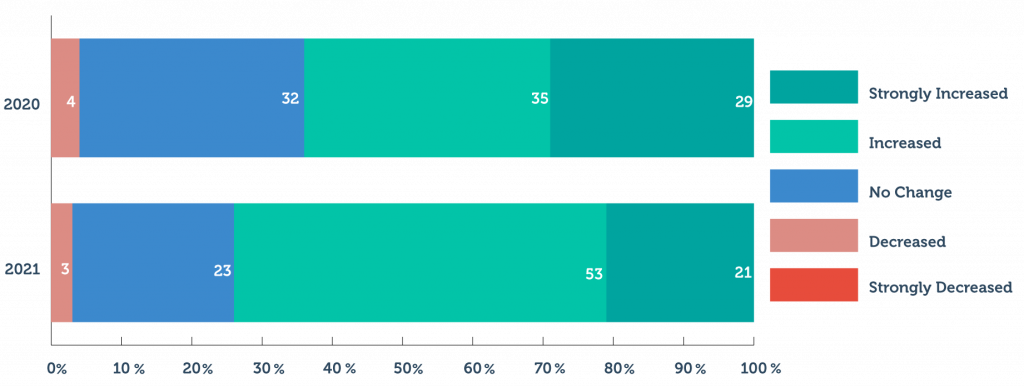

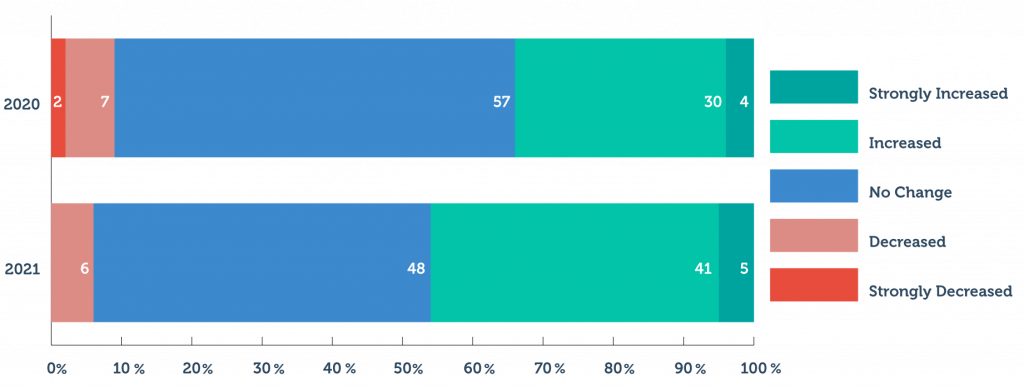

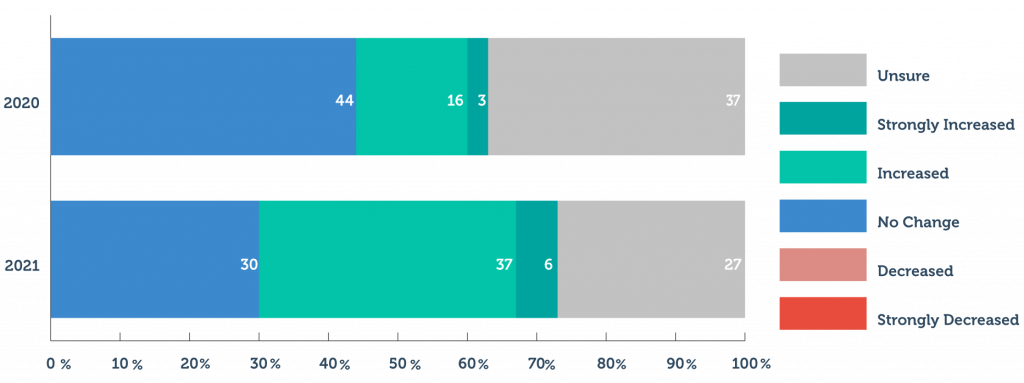

Overall, far more consultants have seen an increase in companies implementing a third-party wellness program than have seen a decrease. Still, the growth in companies implementing these programs is tapering, as 61% of consultants say that interest remains the same across their book of clients, up from 49% in 2019.

The decision to choose carrier wellness programs over third-party vendors continues to decrease in frequency, although that decline has slowed since 2019.

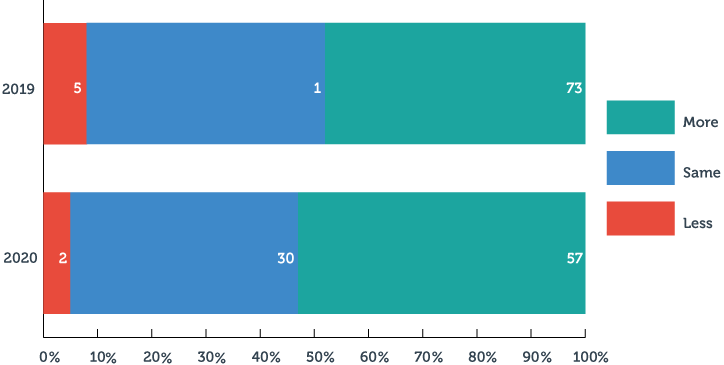

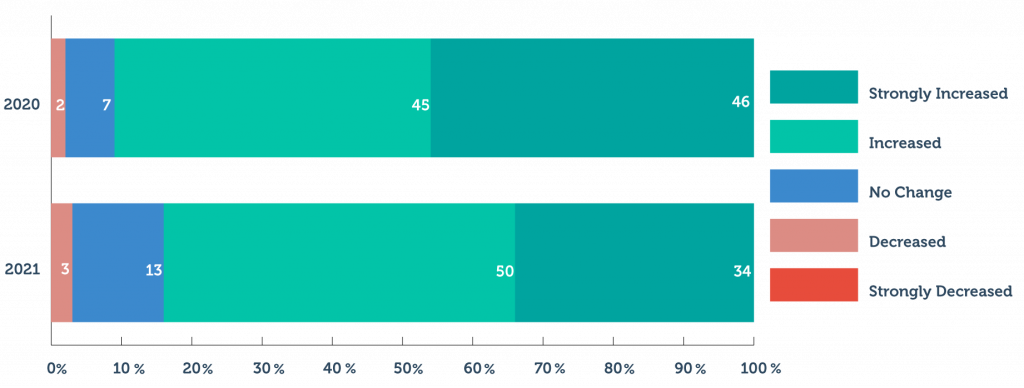

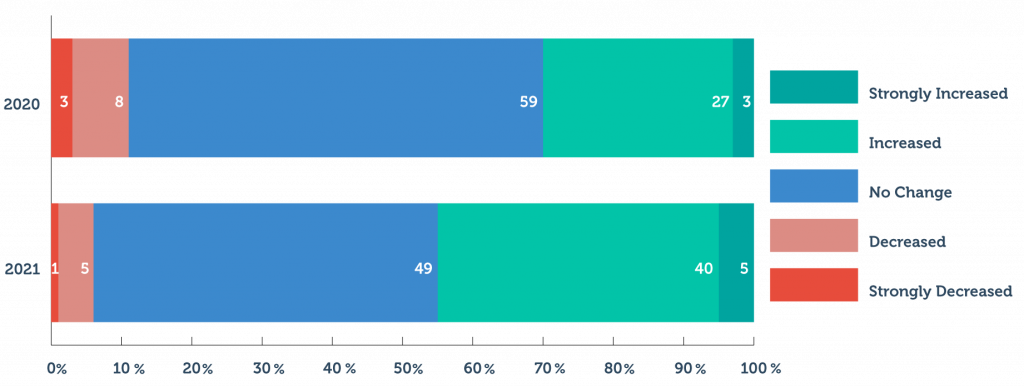

The popularity of centralized wellness platforms has increased in each wellness prospectus, and 2020 was no different. A majority of consultants once again saw more clients asking about these hubs, with just 1-in-20 consultants seeing less of this activity. Growth has slowed from previous years as this interest becomes the norm.

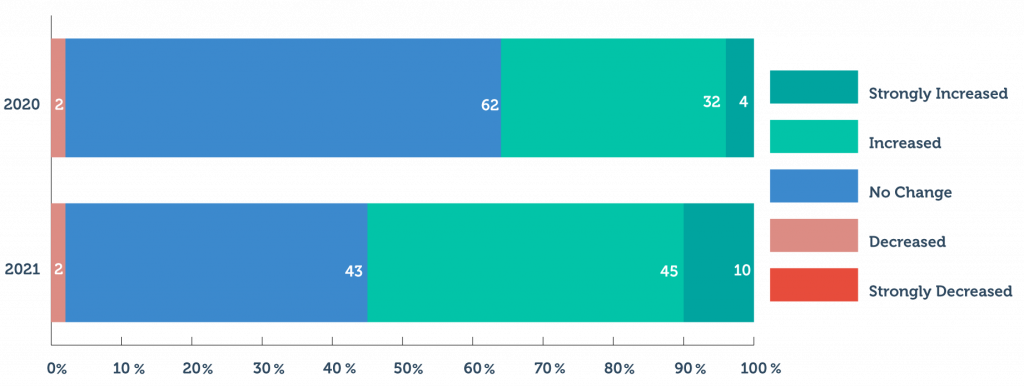

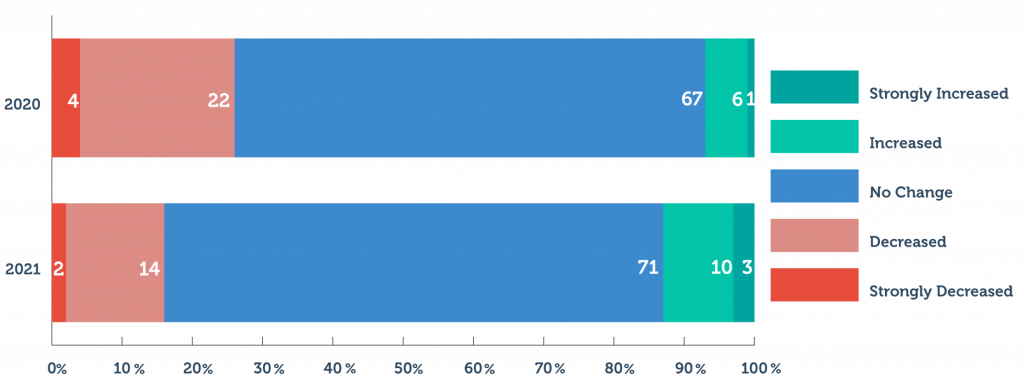

For the third-consecutive year, far more consultants saw a decrease in clients implementing outcomes-based wellness programs. However, the decline has slowed a bit from its peak in 2019.

Consultants continue to report an increase in clients using claims costs to prioritize future point solutions: Companies are investing in benefits that should help improve employee wellness in areas where claims costs are high. The growth rate has slowed since its peak in 2017 and 2018 as this behavior has become the norm. Just 3% of consultants saw a decrease in this behavior among their clients.

Mobile access to wellness programs for employees is overwhelmingly an interest for their employers. At least 3-in-5 consultants have seen an increase in this interest each year of the prospectus.

The growth in point solution implementation continues to grow, albeit at a slower rate than just a few years ago. Brokers report seeing a shift to more “all-in-one” solutions for a variety of reasons (more below).

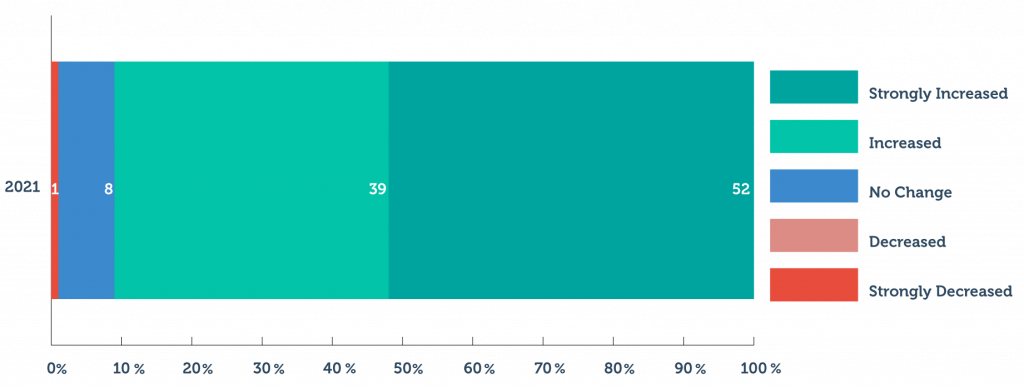

“In the past year, have you seen more clients looking for an all-in-one vendor or piecing together point solutions?”

Companies can choose to invest in employee wellness by purchasing an “all-in-one” solution that provides multiple solutions in one application, or by piecing together various “point solutions” that come from individual vendors.

With the rising popularity of all-in-one solutions, we asked consultants about the biggest issues client experience when implementing multiple point solutions. Point solution vendors can use this data to create products that are more easily implementable.

Companies adopting wellness point solutions can use the data to prepare for successful rollouts and improve adoption rates for their employees.

While a majority of consultants are seeing an uptick in point solution interest (above and to the right), the point solution migration seems to be leveling off in comparison to a few years ago.

“Point solution fatigue” may be setting in for some buyers, and those that were interested in best-in-class, targeted interventions may be reaching a point of relative saturation. It will be interesting to see if the pendulum swings back the opposite way in the coming years.

1. Internal communications strategy (Most Impactful)

2. Integration across solutions

3. Employee awareness of capabilities

4. HR administration burden

5. Complexity of technology for employees

6 Multiple logins for employees (Least Impactful)

No event has ever caused a more dramatic shift in the employee wellness market than the COVID-19 pandemic, which changed the way we conduct business and our personal health needs overnight.

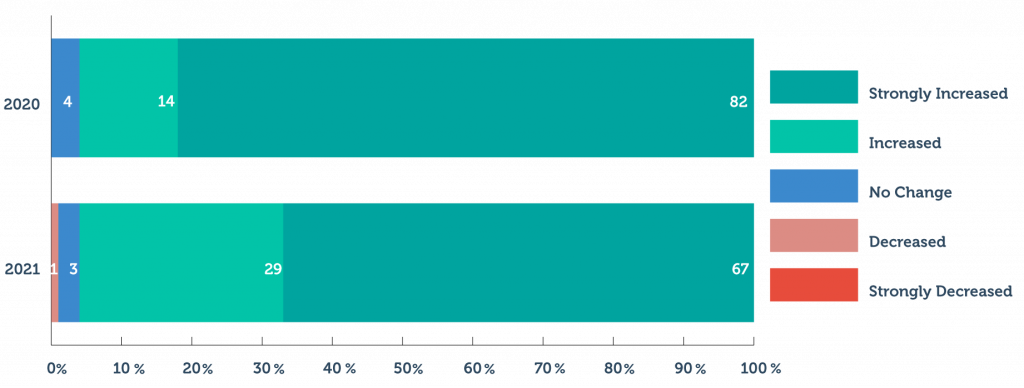

Consultants were asked about 11 individual wellness solutions and how interest in those programs had changed with clients since the beginning of the pandemic. Respondents were then asked to project client interest in these same programs through 2021.

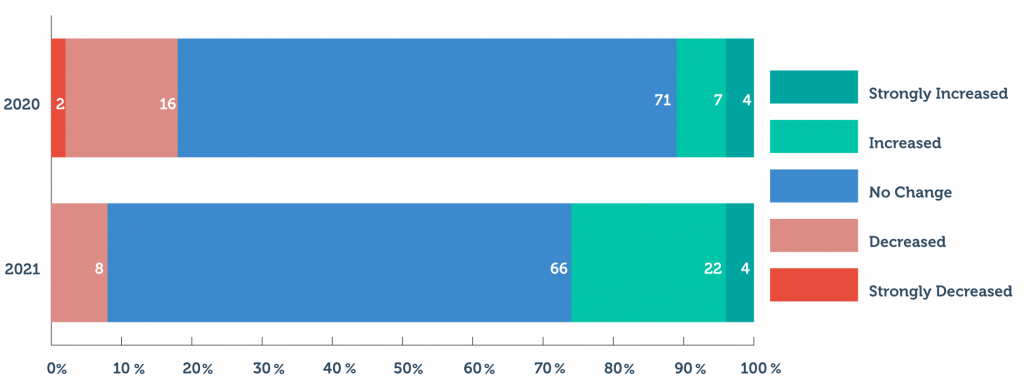

Behavioral Health offerings, which involve the connection between mental and physical health, saw massive interest growth following the start of the COVID-19 pandemic. As many employees dealt with isolation, loss, and changes in routine, employers quickly looked for programs to support them.

An already-slowing interest in Biometric Screenings prior to 2020 was exacerbated by the pandemic and subsequent lockdowns and work-from-home policies. In-person solutions fell in interest across the board, and 88% of consultants reported a drop in Biometric interest. They do expect some bounce-back in 2021 as some portion of employees return to offices.

For many, the global pandemic turned houses into offices, conference rooms, classrooms, and daycares. Parents struggled to balance overseeing remote learning with their own work responsibility.

At the same time, COVID-19 posed enormous health risk for seniors. Their families were often placed in difficult positions for how to provide care.

In response to these lifestyle changes and challenges for their employees, companies showed overwhelmingly increased interest in these programs. Consultants expect interest to continue growing in 2021.

An already-slowing interest in Biometric Screenings prior to 2020 was exacerbated by the pandemic and subsequent lockdowns and work-from-home policies. In-person solutions fell in interest across the board, and 88% of consultants reported a drop in Biometric interest. They do expect some bounce-back in 2021 as some portion of employees return to offices.

For many in 2020, our dining room tables, couches and even bedrooms became our offices and workspaces. Without the constant presence of coworkers in an office, it became easy to relax posture or change other habits.

The change to work from home brings on different health challenges from an office environment, and employers are adjusting accordingly.

The interest in women’s health programs was overwhelmingly unchanged in 2020 according to respondents with a slight downtick. Consultants see much of the same in 2021, with a slight rebound — perhaps as pandemic-driven programs lose momentum.

Of the 11 wellness programs listed in the survey, none saw a bigger shift in market interest than Telehealth. As other areas of life moved virtual — work, school, social, etc. — medicine followed suit, and employers adapted swiftly in 2020.

On average, an estimated 32.6% of respondents’ clients are incorporating diversity, equity, and inclusion objectives into their overall wellbeing strategy.

The COVID-19 pandemic changed the way the world lives, especially how its people work. 2020 and the first half of 2021 brought new challenges to companies and their employees. A transition to a remote workforce was required overnight, and a bigger emphasis was put on financial and mental well-being than ever before.

Vaccines have allowed our world to cautiously reopen, and that has meant a return to office life for some. But the working world will not revert back to what it looked like in February 2020; many changes in our working lives have changed forever, or will continue to evolve as we learn what our “new normal” is. Employers and wellness providers that can evolve to the new needs of employees will give themselves a massive competitive advantage in a volatile job market.

Browse our curated list of vendors to find the best solution for your needs.

Subscribe to our newsletter for the latest trends, expert tips, and workplace insights!

Despite widespread adoption and recognized benefits, why does skepticism still cloud the effectiveness of employee wellness programs?

Address workplace stress head-on with practical solutions to encourage a healthier, more productive work environment.

Discover 25+ insightful statistics about walking and its impact on health and well-being.

Explore senior care statistics that accurately depict the growing importance of eldercare

Used by most of the top employee benefits consultants in the US, Shortlister is where you can find, research and select HR and benefits vendors for your clients.

Shortlister helps you reach your ideal prospects. Claim your free account to control your message and receive employer, consultant and health plan leads.