The Link Between Work Productivity and Sleep

As sleep deprivation significantly affects work performance, is the tradeoff between employees working long hours or being available 24/7 worth it?

Over the next three years, 89% of HR professionals plan on using employee benefits platforms to support employee attraction, retention, and engagement.

Mercer’s Benefits Technology 2023 report further reveals that for 85%, the main objective is to better support workers’ well-being, while 75% want to use technology to expand benefits and make them more inclusive.

As employee benefits become increasingly valuable for the modern workforce, companies are tasked with finding better ways to streamline benefits administration, improve the employee experience, and grow their bottom line.

In this Shortlister article, we explore the role of technology in all three, making a case for why companies need an employee benefits platform.

Employees want more benefits, but not just any kind.

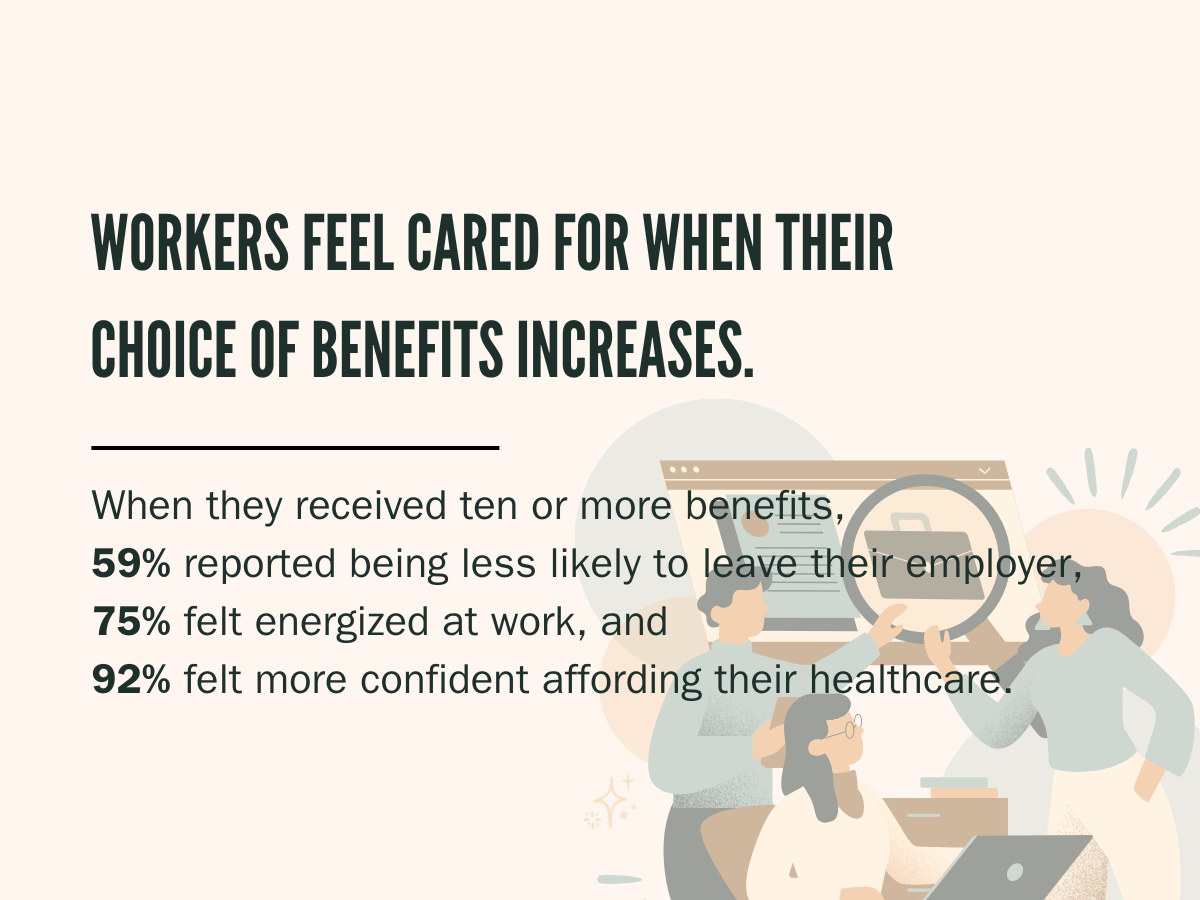

According to Mercer, workers feel “cared for” when their choice of benefits increases.

As the number grows, so too does retention.

So, when they received ten or more benefits, 59% of workers reported being less likely to leave their employer, compared to just 24% of those who didn’t get any.

Another 75% felt energized at work, while 92% felt more confident affording their healthcare.

The Mercer study further shows that, at 93%, flexible working was the most valued health and well-being employee benefit.

However, as the labor market shifts to include a new generation of workers, we keep seeing different benefits trends. The surge of interest in remote working and flexible hours is just one of them, followed by a rise in voluntary benefits.

For example, as reported by Goldman Sachs, there was a massive upsurge in benefits for child and elder care assistance (177%), hospital indemnity (152%), and pet insurance (120%).

Another report on voluntary benefits reveals that, in 2023, 31% of employers used them to support recruitment and retention.

In other words, offering a comprehensive benefits package signals a company’s commitment to employee well-being beyond traditional benefits and salary. More importantly, when it caters to real employee needs, it sets the employer apart from competitors and can foster employee satisfaction.

However, the growing demand for benefits comes with challenges, as traditional benefits administration can’t keep up, indicating the need for a different solution.

Traditional benefits administration refers to manually managing all aspects of employee benefits, from communication and enrolment to compliance and record-keeping.

Expectedly, there are some challenges to this in the modern workplace.

Paperwork, manual data entry, and physical documentation can be an administrative nightmare when managing comprehensive benefits packages, leading to delays in employee enrollment, resolving issues, and benefit changes.

Not only is this time-consuming, but manually processing data can be costly since it’s more error-prone, potentially exposing the organization to financial penalties and legal liabilities.

In fact, Gartner reveals that poor-quality data costs organizations an average of $12.9 million annually.

The traditional benefits administration process usually lacks easy access to information. This challenge can lead to poor communication of benefits and a lack of understanding of the company’s benefit options, coverage details, and enrollment procedures.

Misunderstandings may also lead to suboptimal utilization of benefits, diminishing their value to employees and the organization.

As pointed out above, the administrative burden of manually processing data strains company resources.

Paired with ongoing tasks like enrolling workers into benefits plans, verifying eligibility, making changes, reporting compliance, and more, HR professionals divert their time and attention away from strategic initiatives.

Thus, the importance of benefits technology becomes evident.

Things have come a long way since manually managing HR tasks was the norm.

Now, the modern workplace demands modern solutions.

Between continuous technological growth and companies’ readiness to adapt and evolve, the challenges of traditional benefits administration have transformed into opportunities for the new digital approach.

Employee benefits platforms provide a centralized software solution that facilitates a company’s administration, management, and communication of employee benefits programs. To achieve this, they typically include features for automated enrollment, compliance, eligibility verification, plan management, analytics, and reporting capabilities.

If we dissect this definition and look at employee benefits platforms from a functionality perspective, the following emerge as advantages.

Most of these tools and software solutions offer all-in-one platforms for benefits-related activities. This centralized approach is one of the features that differentiates benefits technology from the traditional method of manually handling HR tasks.

Depending on the provider, employee benefits platforms can integrate with other systems, such as HRIS, payroll, and time and attendance systems. Centralizing such information simplifies administration for HR professionals and provides employees with a unified and consistent experience.

Another direct advantage is automation. This benefit is so widespread that the market for business process automation is set to reach $19.6 billion by the end of 2026.

Most benefits software solutions have a set of integrated automated features. The goal is to simplify HR processes, reduce the administrative burden, minimize errors, and speed up task processing and management.

Benefits administration software introduces customization features that cater to employees’ diverse needs and preferences. For example, companies can easily tailor benefits offerings to match employee demographics, life stages, or individual preferences with just a few clicks.

Additionally, customization enables employees to self-manage their benefits packages, reducing the workload of HR departments.

Most employee benefits platforms offer employees real-time access to their benefits plans. That means they get a dedicated web platform or mobile application to review their coverage, access documents, make changes, etc. This benefit is not only convenient but can also increase company transparency.

A reliable employee benefits platform will include robust analytics and reporting functionalities. These provide quick insights into benefits use, engagement, and overall program effectiveness. By analyzing trends and cost projections, companies can make data-driven decisions to improve their benefits where improvement is needed.

All the functionalities above contribute to one of the most significant benefits – improved efficiency.

Providing a centralized platform that automates HR tasks, simplifies analytics and reporting, and allows easy access and customization will inevitably increase the HR department’s overall efficiency.

However, the advantages of an employee benefits platform go further than its functionalities and can transform business in more than one way.

Digital advancements modernize how companies handle employee benefits, leading to direct advantages for HR and benefits administrators, such as improved efficiency.

However, the benefits expand beyond this, showing signs of improving the entire employee experience.

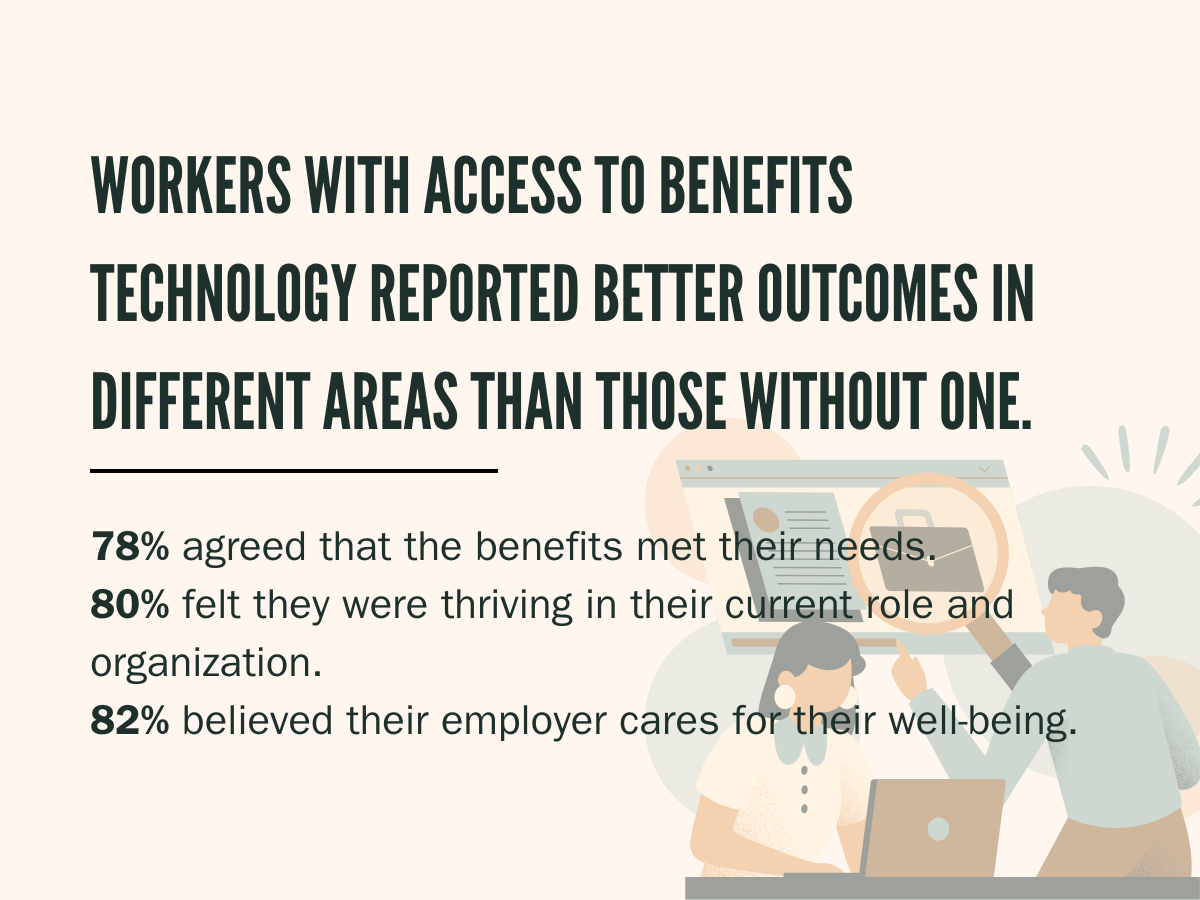

Mercer reveals that workers with access to benefits technology reported better outcomes in different areas than those without one.

In stark contrast to employees lacking access to benefits technology, 47%, 54%, and 56%, respectively, felt the same way as their co-workers.

As important as they are, comprehensive benefits packages come with many compliance forms, taxes, and regulations. Ensuring the company is subject to the Affordable Care Act and following COBRA and HIPPA regulations to HSA and FSA eligibility are just a portion of the tasks involved in managing employee benefits.

Thus, saying an employee benefits platform that automates these manual tasks is beneficial would be an understatement.

Benefits administration software often features built-in compliance tools and reporting capabilities. These help HR teams stay current with regulatory requirements and mitigate risks of non-compliance, thus enhancing overall security and trust within the organization.

Not only that, but these platforms typically include measures to protect sensitive employee data, such as personally identifiable information and health records, ensuring confidentiality and compliance with data privacy laws.

When employee experience increases and efficiency improves, a company is more likely to receive better results.

For example, businesses save money on recruitment and turnover costs by staying competitive in the talent market and keeping retention up. In fact, some sources place the average expenditure for a new hire at $4,700, while other data shows that companies expect to pay between 15% and 30% of the employee’s first-year salary in recruiter commission.

Another direct cost savings is the reduced administrative overhead, saving time and resources for HR departments. At the same time, an employee benefits platform keeps companies up to legal standards, helping them avoid costly penalties, lawsuits, and reputational damage.

Moreover, benefits platforms provide insights into the effectiveness of benefits programs through data analytics and reporting, allowing companies to make informed decisions to optimize their ROI.

Ultimately, the efficient management of employee benefits through these platforms translates into tangible financial gains and a stronger bottom line for the organization.

The exponential market growth of employee benefits platforms reached slightly over a billion dollars in 2023.

By 2032, this number is expected to double.

This increase supports the rising significance of this technology and its mass adoption.

But how can you find the best provider in a rapidly expanding market with so many options?

Reliable benefits technology providers share mutual traits. For example, automation, easy access, responsive customer support, and an intuitive interface are a must. Beyond this, providers should also cover customizable options, integrations, and good analytics and reporting.

Based on these criteria, we shortlisted the following providers:

It’s important to acknowledge that while these providers offer many benefits and industry-leading features, they may not necessarily fit a specific company goal.

Thus, the “best” only refers to what currently satisfies the business and employee’s needs. The choice ultimately depends on different preferences, objectives, and budgets.

From easier access and management to cost and time reduction, the results speak volumes about how a good employee benefits platform can affect an organization.

For example, many of Deel’s case studies show the transformational scope technology has on simplifying administrative tasks, including benefits management. Their collaboration with SafetyWing, in particular, shows cost savings of $10,000 annually and over 30 hours per month saved on administrative work.

Another testament to efficiency is Remote’s success story with Chaleit.

The cybersecurity company partnered with Remote to streamline its global expansion by leveraging its country-specific benefits expertise and compliance services. This collaboration enabled Chaleit to offer competitive compensation and benefits packages, ensuring smooth and compliant international hiring.

Selerix’s collaboration with Graham Health System, on the other hand, shows the importance of a lessened workload for HR and accounting teams. The company’s adoption of an employee benefits platform allowed it to streamline benefits administration and enrollment from a process lasting several months to just three weeks. Additionally, Graham Health System reported an annual workload of over 60 hours less.

As one last example, we take Optivise’s case study with the San Antonio Regional Hospital, which explores a different benefit.

Namely, they wanted to enhance enrollment in their “Core Advantage Plan” and increase participation in their wellness program. Despite introducing an EPO plan with significant cost savings, adoption rates were low due to insufficient education and communication.

However, after implementing a benefits communication strategy, creating a benefits portal, and providing one-on-one benefits education, the hospital saw a 17% increase in EPO enrollment, $1 million in savings, and an improved employee understanding and engagement with their benefits.

In conclusion, the need for a better solution heightens as traditional benefits administration becomes outdated.

Companies striving to stay competitive and ahead of the evolving benefits landscape are adopting employee benefits platforms for more efficient administration, greater employee satisfaction, and long-term business growth.

Disclosure: Some of the products featured in this blog post may come from our partners who compensate us. This might influence the selection of products we feature and their placement and presentation on the page. However, it does not impact our evaluations; our opinions are our own. The information provided in this post is for general informational purposes only.

Content Writer at Shortlister

Browse our curated list of vendors to find the best solution for your needs.

Subscribe to our newsletter for the latest trends, expert tips, and workplace insights!

As sleep deprivation significantly affects work performance, is the tradeoff between employees working long hours or being available 24/7 worth it?

Explore strategies employers can use to enhance employee access to pain management resources and improve productivity and well-being.

If you think a ping-pong table and massage chairs will make employees find long-lasting fulfillment at work, think again.

The high cost of child care, coupled with the pressure it puts on working parents and its long-term effects on employee productivity and retention, is why we need to look closely at the importance of child care benefits for parents.

Used by most of the top employee benefits consultants in the US, Shortlister is where you can find, research and select HR and benefits vendors for your clients.

Shortlister helps you reach your ideal prospects. Claim your free account to control your message and receive employer, consultant and health plan leads.