Fraternization in the Workplace

Is workplace fraternization a recipe for disaster or a catalyst for a stronger work culture? The answer isn’t black and white.

Today, most companies invest big dollars in employee incentive programs because they believe these plans are a powerful tool to improve retention, satisfaction, and productivity. At first glance, the power of rewards may seem undeniable.

Yet, this exact management theory has become a polarizing subject in the corporate world.

Some critics argue that these benefits are illusionary, pointing to a growing body of evidence that shows such schemes may not only fail to deliver the promised benefits but could also lead to unintended negative consequences.

In this article, we explore the effectiveness of such programs and address the question: do employee incentive programs work?

Analyzing various incentive models and their impact on employee behavior and performance, we aim to answer whether these programs truly deliver on their promise to enhance organizational performance and employee well-being or if they inadvertently contribute to workplace challenges.

Most compensation models and employee incentive plans are built upon one simple philosophy – if you want improved employee performance, you reward certain behaviors while punishing behaviors you don’t want.

In fact, for as long as businesses have existed, they have used various mechanisms and forms of incentive pay to motivate employees and instill desired values, all to improve business outcomes.

Today, the vast majority of US and global corporations use some sort of incentivization strategy to boost performance.

There are many types of incentives — from piecework payments for factory employees and stock options for senior executives to commission-based earnings for sales staff — meaning they can be tailored to employees’ unique preferences and companies’ varying budgets.

WorldatWork’s Incentive Pay Practices Study shows that 99% of publicly traded companies use short-term incentives, and 51% offer long-term incentives beyond regular pay, affirming the widespread use of these types of rewards.

But do employee incentive programs work?

While some executives believe that adding financial incentives for performance on top of existing base compensation is unnecessary, the case for employee incentives is undeniably strong.

Rewards, recognition, and incentive compensation can encourage employee productivity, lift morale, drive profitability, and help companies reach their targets.

In fact, organizations with recognition programs see a 14% increase in employee performance and productivity.

So, what do these incentives amount to in terms of returns?

As one McKinsey study suggests, an initial investment of $50 million in incentives can produce a recurring value of $1 billion.

That translates to a 20-fold return on investment (ROI), and the unique benefit is that rewards are only given out once goals are met, essentially making the program self-funded and a lower-risk financial commitment.

However, the advantages of such initiatives extend beyond just financial gains.

With the latest labor trends of “Quiet Quitting” and “Lazy Girl Jobs” signaling broader disengagement across the US workforce, motivating and retaining workers is a top priority for executives.

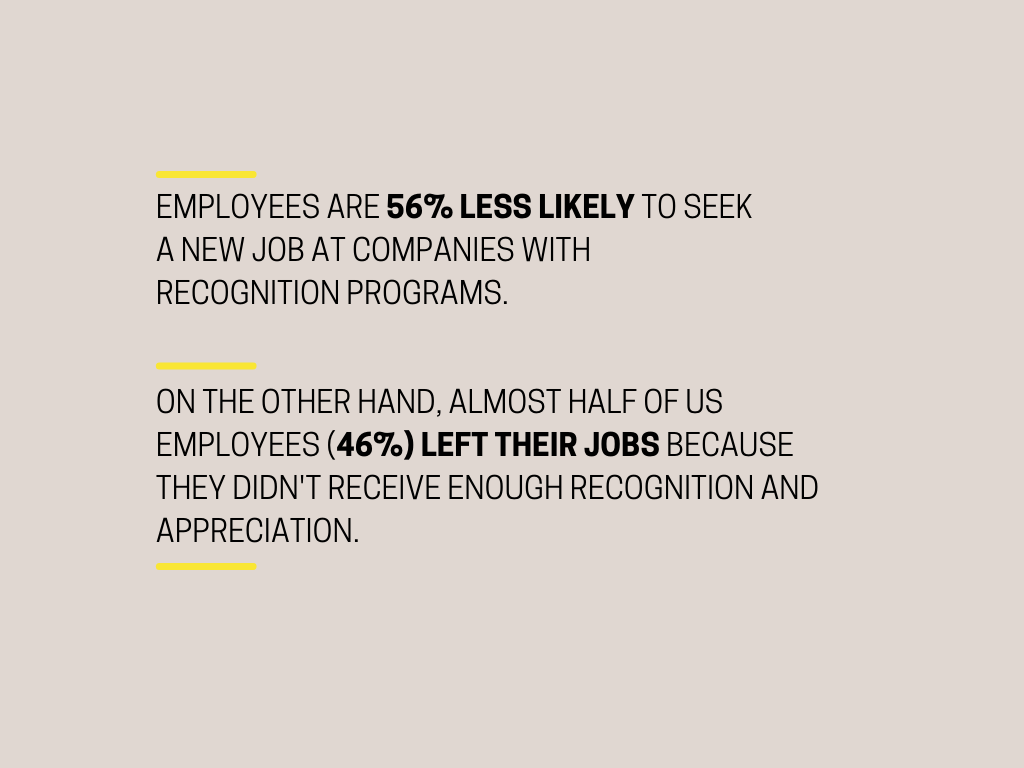

There is a strong link between employee incentives and long-term employee retention, with research indicating that employees are 56% less likely to look for a new job at companies with recognition programs.

On the other hand, almost half of US employees (46%) have left their jobs because they didn’t receive enough recognition and appreciation.

Moreover, a well-designed program of financial incentives and non-financial rewards can create excitement across the organization and push employees to put in more effort.

Simply put, seeing coworkers earn bonuses makes winning infectious, motivating employees to step off the sidelines and join in.

For many job positions, base salary and yearly raises have become guaranteed – they are expected every year regardless of performance.

However, these incremental raises might not be substantial enough to make top performers feel genuinely appreciated and encourage them to stay long-term. While salaries should be competitive, employers must look at the total rewards package beyond base pay and consider incorporating short-term incentives.

But do these employee incentive programs work, or are they only short-term solutions?

In a joint Harvard Business School and Yale study on whether bonuses enhance the sales productivity of a large office supply company, researchers found clear evidence that:

Statistics show that spending on short-term incentives is increasing, now amounting to 6% of a company’s operational earnings on average.

While it may seem like a lot, as much as 74% of companies reported their yearly incentive scheme was “moderately to highly effective” in meeting its goals – making it a worthwhile investment.

These facts, coupled with the growing adoption of rewards and recognition programs, suggest that incentives will stay popular with both employees and employers for a long time.

However, there are certain challenges that companies must consider when designing their incentive programs.

Compelling evidence suggests that while financial incentives can reinforce culture, they can also have the opposite effect, decreasing performance and leading to ethical lapses.

One of the biggest arguments against incentive pay is that it might tempt employees to behave unethically or even illegally to meet their targets.

Numerous studies show that when employees are faced with the possibility of missing out on a bonus, they could be swayed into cutting corners or bending the rules to ensure they hit their goals.

For example, in 2020, the third-largest bank in America — Wells Fargo — paid a staggering $3 billion over allegations that its employees engaged in customer abuses, including opening unauthorized accounts, issuing debit and credit cards without consumer knowledge, and even forging signatures.

What prompted employees to act dishonestly, in this case, was the desire to hit daily sales targets and receive bonuses.

Instances such as these are likely the result of poor plan design, yet this scandal highlights how incentives are a double-edged sword – they can be both advantageous and dangerous if not carefully crafted.

As mentioned before, there is a long list of benefits associated with extrinsic rewards. However, there’s a fine line where these incentives can become counterproductive and erode interest in the work itself.

Over time, incentives can lead to a sense of entitlement among employees and diminish motivation, dragging down performance levels.

For instance, in the early 1990s, Hewlett-Packard managers saw an initial rise in goal achievement when they introduced 13 different incentive pay programs across various sites.

However, as the benchmarks were raised, incentive pay decreased, leading to employee dissatisfaction and widely inconsistent team performance.

Similarly, a study published in the Harvard Business Review in 2017, which surveyed over 13,600 employees in the United Kingdom, found that incentive pay resulted in lower job commitment and decreased trust in leadership.

Additionally, employees reported increased workplace stress when incentives were tied directly to performance metrics.

These findings shed light on the complex relationship between incentive programs and their long-term effects on employee morale and organizational health.

Many documented cases show that the increase in the use of incentive pay has been linked to the rise of wealth disparities and worsened gender pay inequalities.

To give an example, ADP Research Institute found that women, on average, earn 17% less than men, equal to $15,000 annually. However, when incentive pay is factored in, the gender pay gap increases to 19%, or $18,500.

This issue isn’t just for those starting out in their careers – it extends all the way to the top.

Even among the highest-ranking executives, where you might expect fairer pay, the system of giving out company shares and stock options as part of the pay package tends to favor men over women.

This could lead to women, who are already fewer in these high positions, getting an even smaller piece of the pie.

In fact, among the top 1000 Fortune companies, only about 7.4% of CEOs are women, and these female leaders often receive a smaller portion of their pay in the form of these lucrative incentives compared to their male counterparts.

When it comes to the success of employee incentive programs, there’s a delicate balance to strike.

A study by Gallup found that the success of bonus pay is practically universal, and money seems to be a powerful motivator across all regions and industries.

However, depending on their job and field a few exceptions need to be considered.

For example, for repetitive tasks or jobs requiring physical exertion, cash bonuses seem to be most effective.

For jobs requiring creativity and thinking outside the box, these rewards might hold employees back because they will be discouraged from taking risks and trying something new. Instead, intrinsic rewards, like giving employees more creative freedom or job flexibility, may be more effective for jobs in these fields.

Another study showed that project managers think the key to a successful incentive program includes getting bonuses on time, having clear goals, good leadership from site managers, and checking on performance.

Moreover, it’s essential to recognize that the cultural context of the organization and individual preferences play a significant role in determining the effectiveness of incentive programs.

Implementing a one-size-fits-all approach may not yield the desired results, requiring tailored strategies for different teams and individuals within the organization.

Ultimately, employers must consider both the intended and unintended consequences and determine if incentive pay is a good fit for their organization.

Drawing on insights from many scientific papers, we list the following strategies and practices for creating employee incentive programs that drive engagement, productivity, and alignment with organizational goals.

Considering all these points, business leaders must take a fresh look at how their companies handle risk assessments for incentive pay plans, all while questioning, “Do employee incentive programs work as intended?”

In short, they need to weigh all the possible risks and results and ensure a system is in place to monitor how employees adapt to and operate with the new incentive plan.

These reevaluations should happen continuously and cover all aspects of the business. It’s not just about spotting risks that could hurt the company financially, but also about noticing any employee actions that could damage its reputation.

In conclusion, while employee incentive programs have proven their worth in boosting performance, engagement, and retention, their effectiveness hinges on careful design, transparent communication, and ongoing evaluation to make sure they promote the desired outcomes without any harmful consequences.

Disclosure: Some of the products featured in this blog post may come from our partners who compensate us. This might influence the selection of products we feature and their placement and presentation on the page. However, it does not impact our evaluations; our opinions are our own. The information provided in this post is for general informational purposes only.

Senior Content Writer at Shortlister

Browse our curated list of vendors to find the best solution for your needs.

Subscribe to our newsletter for the latest trends, expert tips, and workplace insights!

Is workplace fraternization a recipe for disaster or a catalyst for a stronger work culture? The answer isn’t black and white.

HR should be one of the company’s most helpful and valuable departments. However, for most employees, that is not the case.

As there’s no such thing as a perfect or risk-free work environment, can PEOs benefit companies in managing threats, and to what extent?

As the majority of the workforce remains disengaged, enhancing employee recognition through incentive platforms like Awardco emerges as a solution.

Used by most of the top employee benefits consultants in the US, Shortlister is where you can find, research and select HR and benefits vendors for your clients.

Shortlister helps you reach your ideal prospects. Claim your free account to control your message and receive employer, consultant and health plan leads.