Multi-State Payroll Processing Guide for Employers

Hiring across state lines? This multi-state payroll processing guide breaks down everything you need to know to stay compliant.

As healthcare costs continue to climb, more employers are exploring solutions to manage expenses and provide financial relief to their employees.

One effective tool in this effort is the adoption of Flexible Spending Accounts (FSAs), which offer both employers and employees significant tax advantages and cost savings.

In fact, savings from flexible spending accounts reached an estimated $30.7 billion in 2020, marking an 8.7% increase from the previous year.

This report explores the strategic use of healthcare flexible spending accounts, examining their growing role in mitigating rising healthcare costs and improving employee benefits packages.

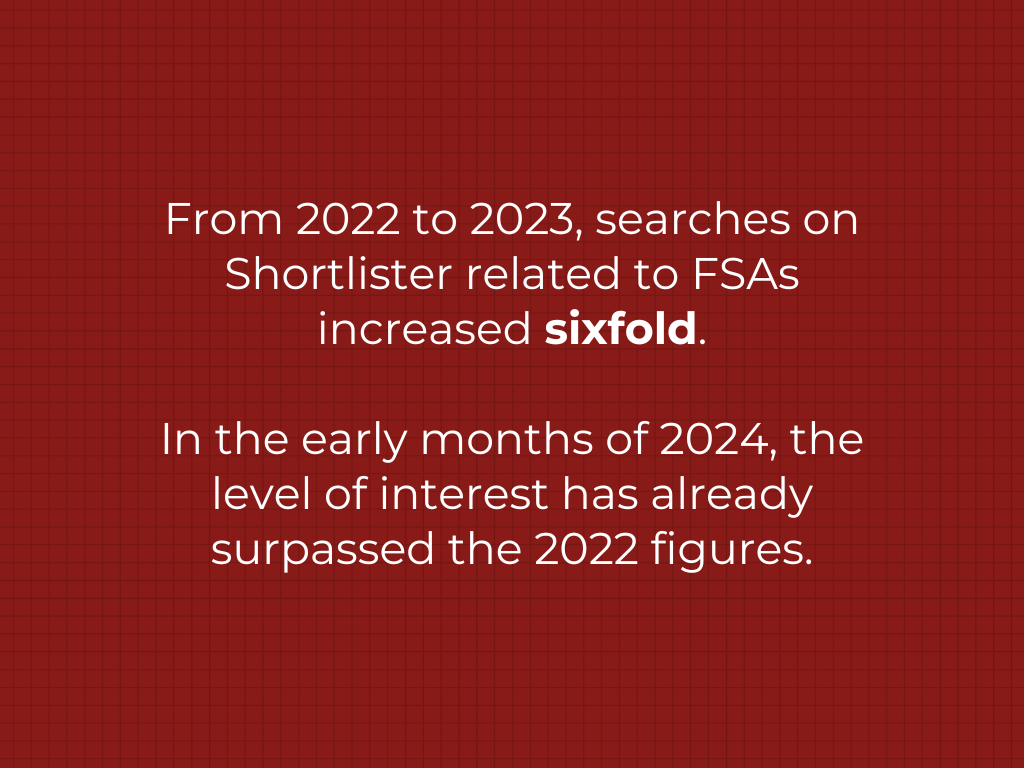

According to data gathered from our internal sources, interest in healthcare Flexible Spending Accounts (FSAs) has dramatically increased over the years.

From 2022 to 2023, the number of searches on our platform related to FSAs has increased sixfold. In just the early months of 2024, the level of interest has already surpassed that of the 2022 figures.

Additionally, the number of projects associated with FSAs has consistently risen over the past year, indicating growing engagement and implementation in the workplace.

Given these trends, we anticipate that healthcare FSAs will gain increasing recognition and value in the workplace in the coming years. These expectations align with broader industry trends, which also indicate a growing appreciation for FSA ‘ benefits.

In recent years, healthcare FSAs have undergone several significant developments. To name a few, there have been changes to contribution limits, updates to usage regulations, and expansion of items eligible for reimbursement.

These changes, alongside external factors like rising healthcare costs and economic pressures, have contributed to the increased adoption and use of FSAs as a financial tool for managing healthcare expenses.

The healthcare situation in America is in dire straits. A shortage of medical personnel, skyrocketing prescription costs, and long wait times for treatment are among the many barriers to accessing care.

Approximately half of US adults find it challenging to afford healthcare, with one in four reporting that they or a family member have faced difficulties covering medical expenses over the past year.

In fact, a shocking 61% of uninsured adults have either delayed or foregone necessary healthcare due to cost concerns.

The latest research published by KFF in March this year shows that dental services are the most commonly deferred type of care due to cost, with 35% of adults postponing these services in the past year. Vision services and hearing aids are also frequently delayed, affecting 25% and 10% of adults, respectively.

With rising healthcare costs putting a significant financial strain on many American families, the adoption of healthcare FSAs has seen a notable increase.

According to a 2023 Employee Benefit Research Institute (EBRI) survey, 44% of respondents reported that their employers currently offer FSAs.

Another study by the National Business Group on Health shows that the number of employers that offer FSAs rose from 52% in 2015 to an estimated 66.3% in 2023. The report notes that the increasing prevalence of FSAs, with a 27% rise in less than a decade, is likely driven by escalating healthcare costs.

Unsurprisingly, the 2023 Benepass Benchmark Guide reveals that healthcare FSAs are the most popular pre-tax accounts, followed by HSAs and dependent care FSAs.

But what makes these accounts so appealing?

Healthcare FSAs are particularly valuable because they offer tax-free access to services not typically covered by other health plans, such as dental and vision care, which are often postponed or avoided due to cost.

Moreover, FSAs offer significant tax advantages for both employees and employers.

Contributions to an FSA are deducted from the employee’s salary before income and payroll taxes are applied. This reduces the employee’s taxable income, lowering overall tax payments.

The same principle applies when the money is spent, meaning withdrawals from FSAs for eligible expenses are also not taxed.

Since contributions to FSAs are made pre-tax, employees can save approximately 30%, depending on their tax bracket.

For employers, offering FSAs reduces the total payroll subject to taxes, leading to substantial savings on employer contributions to Social Security and Medicare taxes.

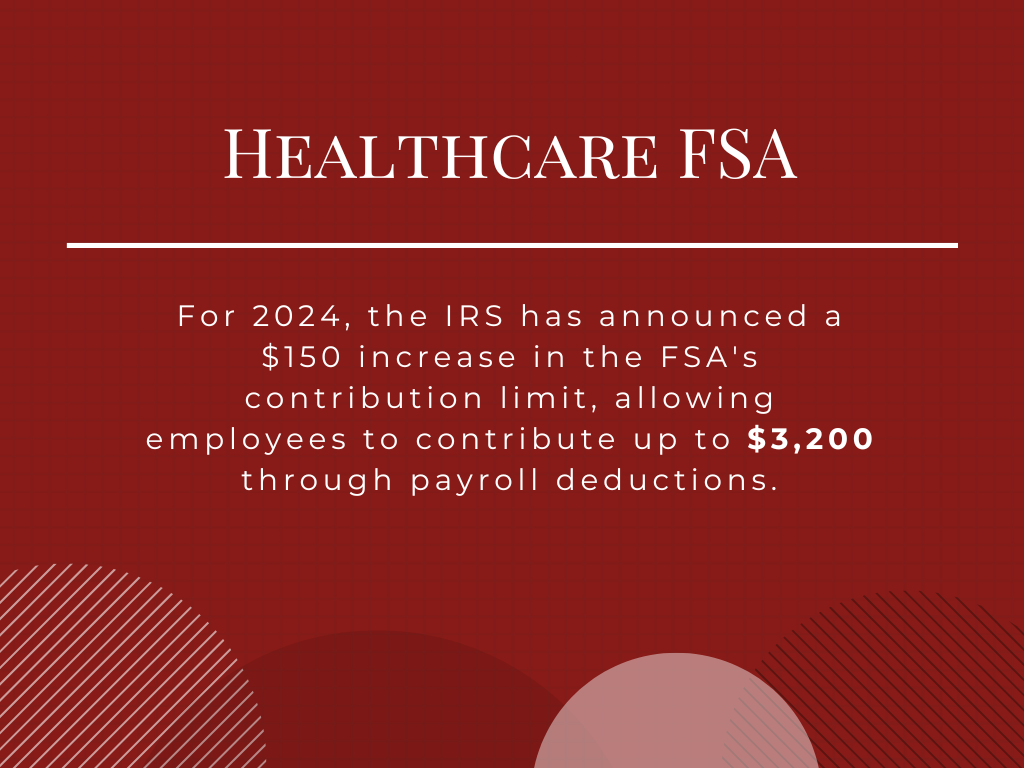

The IRS adjusts the maximum contributions allowance for FSAs each year based on inflation. As expected, these limits have progressively increased over the last few years.

In 2022, the contribution limit for FSAs was set at $2,850, and by 2023, this limit had risen to $3,050.

For 2024, the IRS has announced a $150 increase in the contribution limit, allowing employees to contribute up to $3,200 through payroll deductions. These contributions are exempt from federal income tax, Social Security tax, and Medicare tax.

If an employee’s spouse also has access to an FSA through their employer, each spouse can contribute up to the maximum limit, potentially totaling $6,400 for the household. Additionally, employers may contribute to their employees’ FSAs if the plan terms allow it.

As employees and businesses increasingly recognize the benefits of healthcare FSAs, the amounts invested in these accounts have risen significantly.

Data from the IRS and the Bureau of Labor Statistics show a steady increase in average contributions to FSAs yearly since 2015. By 2022, the average contribution had reached approximately $2,400.

Interestingly, contribution amounts vary by age, with younger account holders typically contributing less.

In 2020, employees under 25 contributed an average of $499, while those aged 45 to 54 contributed the most, averaging $1,430. Older workers also made substantial contributions, with an average of $1,427.

Flexible Spending Accounts (FSAs) were initially introduced before Health Savings Accounts (HSAs), and they came with a significant limitation: unspent funds were forfeited at the end of the year.

This “use it or lose it” rule was a major concern, as it pressured employees to spend all their funds unnecessarily by the year-end deadline, often leading to rushed expenditures.

Today, FSAs have evolved to be more user-friendly by incorporating features that reduce the pressure to spend quickly.

Many employers now offer a grace period extension, which permits an additional 2.5 months after year-end to use the remaining FSA funds. This “carryover” option allows employees to roll over up to $640 of unused funds into the plan next year.

As of 2022, about 74% of FSA users with the carryover option utilized it, although the average amount rolled over was just $307, significantly less than the maximum allowed.

Despite these improvements, a considerable percentage of FSA funds still go unclaimed.

According to the Employee Benefit Research Institute, over 40% of FSA holders leave money unspent, typically between $339 and $408 annually. In total, these forfeitures amount to over $1 billion each year.

The issue often lies in a lack of understanding about how FSAs work.

To address this, employers must provide clear education on the benefits of FSAs and set up reminders towards the end of the year so that employees can fully utilize their accounts without wasting them.

While most people know which items FSAs cover, they might not realize that countless everyday health items are also eligible for tax-free spending.

Healthcare FSAs can be used on routine expenses like bandages, sunscreen, and contact lenses to more significant costs like laboratory fees, ambulances, x-rays, and even specific home improvements for disability accommodations.

The good news is that the list of eligible products is long and continues to expand, too.

For example, recent updates have included menstrual care products and a broader range of over-the-counter medications, such as pain relievers and allergy treatments.

Surprisingly, even specialized items like oral light therapy devices for dental pain or masks designed to alleviate migraine symptoms through compression and heat are covered.

In terms of spending trends, data indicates that the most frequently purchased items with FSA funds include doctor visits (42%), over-the-counter medications (38%), medical supplies and equipment (34%), and prescription medications (32%).

It’s estimated that the average household spends about $1,600 annually on items that qualify for FSA spending.

In other words, health FSAs offer great savings opportunities that many may not fully utilize. As such, employers can assist their employees in maximizing these benefits by providing access to comprehensive lists of eligible expenses.

According to internal data from Shortlister, our users commonly search for Health FSA benefits using a specific set of keywords.

Senior Content Writer at Shortlister

Browse our curated list of vendors to find the best solution for your needs.

Subscribe to our newsletter for the latest trends, expert tips, and workplace insights!

Hiring across state lines? This multi-state payroll processing guide breaks down everything you need to know to stay compliant.

Retirement may feel like an abstract goal for many employees, but strategic planning becomes crucial in securing a comfortable future for millions of Americans.

What’s the smarter path to growth? An Employer of Record that eliminates the need for legal entities or a PEO that optimizes your existing infrastructure?

Discover the growing trend of consumers utilizing BNPL services to pay for purchases.

Used by most of the top employee benefits consultants in the US, Shortlister is where you can find, research and select HR and benefits vendors for your clients.

Shortlister helps you reach your ideal prospects. Claim your free account to control your message and receive employer, consultant and health plan leads.