Why do We Hate HR?

HR should be one of the company’s most helpful and valuable departments. However, for most employees, that is not the case.

Three in five people admit being untruthful on their resume at least once.

The study by StandOut CV exploring the numbers behind resume lying and fake job references shows that this was even higher for those ages 18 to 25, exceeding 80%.

Given the extent of this misinformation problem, pre-employment screening has become an inseparable part of the hiring process. It’s also not unusual for a company to assess existing employees before their promotion or reassignment.

While this can be done independently, employers often hire background check companies to simplify the process.

However, background checks, especially when using third parties, come with legal responsibilities under the Fair Credit Reporting Act (FCRA). The Act ensures fairness, accuracy, and transparency in information, protecting both the employer’s business interests and the applicants’ rights.

Below, we look in-depth into the FCRA, background checks, and their implications for employers.

Until the 1960s, credit reports contained subjective information about an individual’s character, habits, personality, and health. This led to inaccurate and, often, unjust reporting, leaving no space for consumers to correct errors or outdated information in these files.

However, on October 26, 1970, the U.S. Congress passed the Fair Credit Reporting Act into law.

The FCRA was designed to promote data accuracy, fairness, and privacy in consumer reporting agencies by regulating how they collect, distribute, and use data, including credit information.

At the same time, the Act allows consumers the right to access and challenge this information, giving an extra layer of protection against inaccuracies or bias.

More importantly, the FCRA ensures that consumer data expires after a specified time, making it one of the first data privacy laws.

Enforced by agencies like the Federal Trade Commission (FTC) and the Consumer Financial Protection Bureau (CFPB), the FCRA forms the foundation of consumer rights law in the United States, safeguarding consumers’ data privacy and integrity.

Since its enactment, the Act has been amended many times to follow evolving regulatory standards and consumer protection needs, directly impacting how employers conduct employment assessments.

Employment background checks review and verify information about job candidates or employees, including their criminal record, employment history, education, credit history, social media use, and other relevant information.

As a significant part of the hiring process, especially in recent years, they allow companies to assess whether a job candidate is qualified for the position, trustworthy, and a good fit.

Statistics show how many employers conduct background checks, and it’s a surprisingly high number.

Namely, in 2018, 95% of companies conducted a background check.

More recent data from the Background Screening: Trends in the U.S. and Abroad research confirms their prevalence, putting the number at 93% globally. The report further shows that this practice is more common in U.S.-based companies (95%), but slightly less for other organizations (79%).

Additionally, 76% of businesses globally have a documented screening policy.

Understanding the correlation between FCRA and background checks becomes paramount with such high numbers and even higher stakes.

FCRA and background checks overlap where candidate data falls under consumer reports. So, when companies perform these screenings, especially with third-party agencies, they must comply with FCRA guidelines to protect the applicant’s privacy and rights.

There are, however, rules to FCRA’s applicability, which we explore below.

The Fair Credit Reporting Act applies when a consumer report is used, such as credit transactions, insurance underwriting, tenant screening, or employment.

Employers are subject to FCRA when they use external sources to conduct background checks on applicants, employees, contractors, temporary workers, volunteers, etc.

This federal law governs how consumer reports, including standard background checks, are obtained and handled. It ensures that employers have a legally permissible purpose for obtaining these reports and that U.S. citizens and residents are protected.

Comprehending FCRA background checks requires a thorough knowledge of all components. The following are some key definitions employers should know, as described in the Act.

1. What is a consumer?

A consumer is any individual whose information is issued in a consumer report. In the case of background assessments, the consumer is the job applicant.

2. What are consumer reports?

Consumer reports are any written, oral, or other forms of communication from a consumer reporting agency that includes information about a consumer’s creditworthiness, credit standing, credit capacity, character, reputation, personal traits, or lifestyle. These reports determine eligibility for the following:

Credit or insurance primarily for personal, family, or household use

Employment purposes

Other purposes authorized under section 604 of the Fair Credit Reporting Act.

3. Who can access a consumer report?

Only those with a valid need can access a consumer report, such as banks, landlords, or employers.

4. What is a consumer reporting agency?

According to the FCRA, a consumer reporting agency refers to any entity that routinely collects or assesses consumer credit or other information to provide consumer reports to those with a valid need to access them, whether for a fee or on a nonprofit basis.

If we take an in-depth look into consumer reporting agencies beyond their definition under FCRA, their role expands to the following:

For the needs of the workplace, employee background check companies take on the role of CRAs. Both terms refer to organizations that gather and provide information on individuals’ backgrounds.

Achieving FCRA compliance means identifying areas where issues are most likely to arise. For companies who use third parties, these are:

A joint publication of the Equal Employment Opportunity Commission and the FTC outlines what employers need to know about FCRA background checks.

We’ve summarized the findings below:

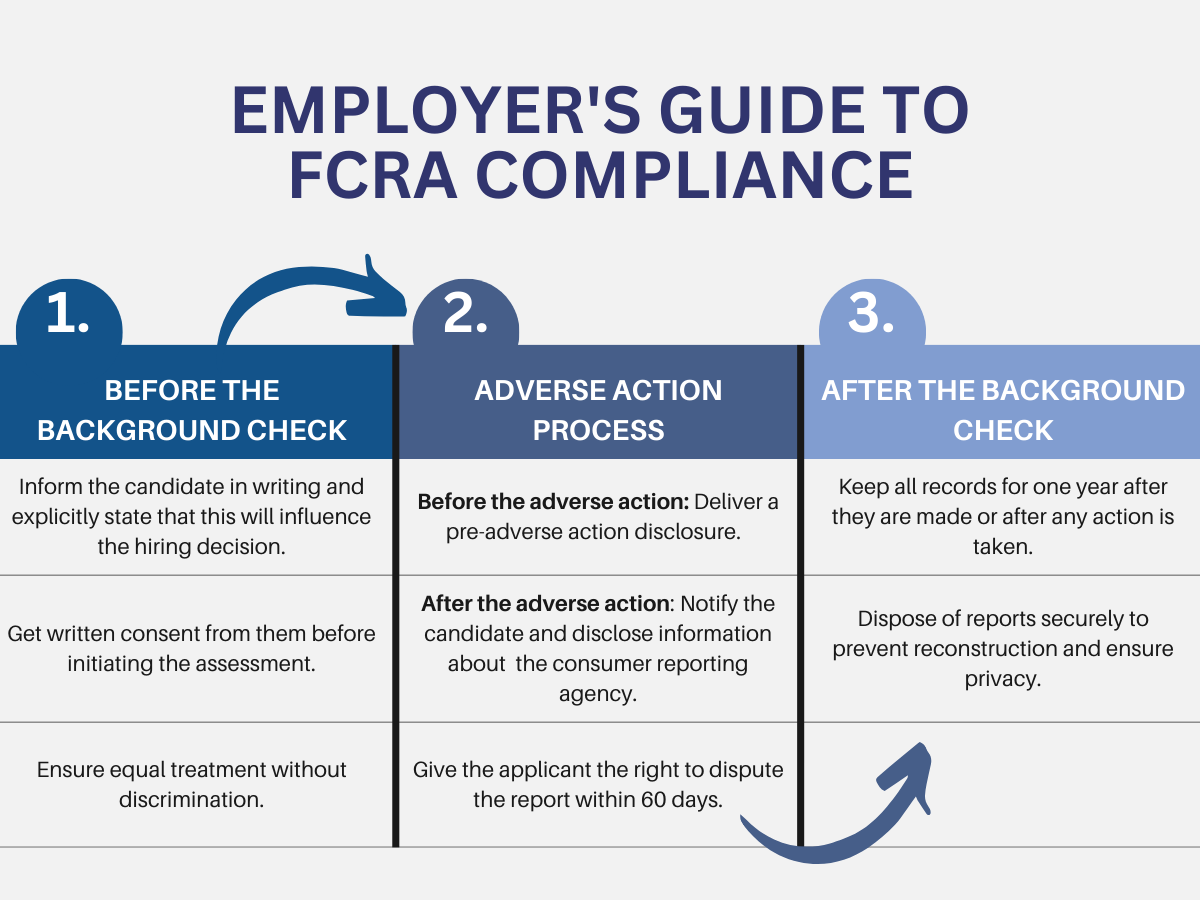

FCRA compliance begins prior to the background check process. In fact, before requesting background information, employers must:

After obtaining them, employers should use all information responsibly, ensuring it’s relevant to the job application.

Moreover, they must comply with federal anti-discrimination laws when using an applicant’s or employee’s data to make an employment decision.

This means background checks should ensure equal treatment without discrimination based on race, nationality, sex, religion, disability, genetic information, or age. Employers should refrain from asking for family medical history or, if obtained, not use it to make a hiring decision.

The Equal Employment Opportunity Commission enforces these laws.

Companies should also be ready to make exceptions for issues in an employment assessment due to a disability.

In that case, they should give the applicant or employee a chance to show they can do the job unless it causes significant financial or operational hardship.

Specific procedures are in place to inform the individual in the case of an adverse action, such as not hiring the applicant or firing an employee.

In this phase, the employer should deliver a pre-adverse action disclosure.

This document includes a copy of the report and a summary of the consumer’s rights under the FCRA provided by the background check company.

The employee or applicant can review the data and explain any negative information with this notice.

If the company proceeds with the adverse action, it must notify the individual that they were rejected due to information found in the report.

Moreover, as part of this action, the employer should disclose the consumer report agency that provided the data (name, phone, and address), confirm that the agency had no say in the decision, and give the applicant or employee the right to dispute the report and receive another free one within 60 days.

Under the EEOC, employers must keep all employment records for one year after they are made or after any action is taken, whichever is later. This period extends to two years for educational institutions, federal contractors, and state and local governments.

After completing the recordkeeping requirements, as per FTC guidelines, employers should dispose of reports securely to prevent reconstruction and ensure consumers’ privacy.

Trust is reciprocal.

Therefore, as companies evaluate whether they can trust their candidates or employees, they should also ensure that these individuals feel safe and protected.

The line between protecting the company’s interests and intruding on a person’s privacy is thin, which is why laws are in place to ensure an ethical and responsible assessment.

However, in addition to complying with the law, employers are responsible for improving the FCRA background check process and ensuring it positively impacts the employee experience.

The following practices can help with this.

First, create consistency.

Having a policy in place helps companies set up clear guidelines and procedures to ensure compliance with the laws.

Although there isn’t a one-size-fits-all approach, when developing a background check policy, make sure it checks out the following:

Next, invest in quality.

Choosing a reliable consumer reporting agency is vital for such a sensitive matter.

This means the background check company should be FCRA compliant, with a track record of accuracy and a commitment to data security and privacy. In other words, look for robust security measures, strong encryption, and reliable data verification processes.

Moreover, the provider’s methods should be thorough, covering all relevant aspects such as criminal history, employment verification, and education.

Finally, ensure accuracy.

In other words, employers should meticulously follow all procedures, from providing the correct documentation to properly handling data to avoid legal consequences.

However, even then, errors and disputes can still happen.

In the case of a data discrepancy, the FCRA requests immediate written notification of any inaccuracies in the report.

When the applicant or employee disputes any consumer information, the employer then must investigate and contact the consumer reporting agency to verify its accuracy.

In case of errors, they should correct the data and provide updated details to the consumer.

The FCRA, like most regulations, is prone to changes.

This means it keeps transforming and upgrading, encouraging employers to stay compliant and up to date.

For example, in January 2024, the Consumer Financial Protection Bureau issued new guidance to companies that provide background checks and credit reports.

One of the advisory opinions focuses on CFPB and background screening, stressing that this process must be complete and free of outdated or legally restricted information.

The other part focuses on the CFPB and file disclosure and emphasizes that consumers have the right to see all the information in their credit files, including where it came from. This helps them correct any mistakes affecting their job opportunities.

So, what happens if an employer fails to follow the legal considerations and updates?

According to Feldman Legal Group, the damages for violations of the FCRA can result in legal consequences for employers.

In case of negligence, employers will cover violation costs, attorney’s fees, and actual or statutory damages ranging from $100 to $1,000 per violation.

For frequent or willful violations, the punitive damages can be higher.

While the costs may not seem like a lot, keep in mind that FCRA violations are common, and the fees and fines can increase significantly if more employees or applicants join a lawsuit.

1. Risk: Time Constraints

Background checks can be lengthy, especially if we consider all FCRA requirements, which could cause hiring teams to lose the candidate.

In fact, Statista reveals how long prospective employees in the U.S. are willing to wait before moving to another opportunity.

Namely, 41% responded that they’ll wait between one week and less than ten days. Another 22% were willing to wait between ten days and less than two weeks, and only 20% agreed to wait over two weeks.

How to Avoid: Streamlined Process & Better Communication

According to Indeed, pre-employment background checks take two to five business days. Although this period is shorter than when employees are willing to wait, it can be prolonged for different reasons.

So, how can employers avoid this?

For starters, employers should use efficient and reliable background check services to reduce processing time and prevent losing candidates due to lengthy background checks. Moreover, they must set clear expectations about the timeline and regularly inform candidates.

2. Risk: Consent and Complex Procedures

A significant risk area involves properly handling data, obtaining consent, and adhering to established procedures and adverse actions.

Failure on each of these fronts can lead to legal violations and penalties.

How to Avoid: Understanding FCRA Compliance and The Risks

Companies must provide clear disclosures to candidates and obtain explicit written consent before proceeding. These forms should be separate from other documents and clearly presented.

Moreover, as part of the procedures imposed by the Act, employers should provide applicants or employees with pre-adverse action notices, copies of background check reports, and a summary of their rights to dispute findings before final decisions are made.

3. Risk: Inaccuracies or Incomplete Reports

Another common pitfall is handling the data from start to finish. Also, relying on inaccurate or incomplete background check reports can pose a compliance risk.

How to Avoid: Partnering with Reputable CRAs

Regularly reviewing and verifying information provided by consumer reporting agencies helps ensure the accuracy and fairness of the screening process. Another way to ensure this is by partnering with reputable CRAs, preferably accredited by the Professional Background Screening Association(PBSA).

Moreover, the FTC and EEOC guidelines on recordkeeping must be followed to ensure privacy and compliance.

Navigating the complexities of a law such as the Fair Credit Reporting Act can be cumbersome, but it’s a necessary step.

By comprehending its nuances, setting up a screening policy, and partnering with a reliable provider, employers can streamline this process and enhance compliance.

Ultimately, FCRA background checks are an ethical and transparent process that guarantees protection for employers while promoting human rights and employment standards in the workplace.

For more information on FCRA, background checks, and their relevance in the workplace, you can check the following resources:

Content Writer at Shortlister

Browse our curated list of vendors to find the best solution for your needs.

Subscribe to our newsletter for the latest trends, expert tips, and workplace insights!

HR should be one of the company’s most helpful and valuable departments. However, for most employees, that is not the case.

Can small businesses truly compete with corporate giants by leveraging employee incentive programs, and what unique strategies can they employ to motivate and retain top talent?

In a world that’s constantly changing, the question isn’t whether you can afford to plan a career—it’s whether you can afford not to.

Despite their popularity, are employee incentive programs truly effective, or do they secretly undermine the very productivity and morale they aim to boost?

Used by most of the top employee benefits consultants in the US, Shortlister is where you can find, research and select HR and benefits vendors for your clients.

Shortlister helps you reach your ideal prospects. Claim your free account to control your message and receive employer, consultant and health plan leads.