Can I Cash Out my 401(k) while still Employed?

You can cash out 401(k) early while still working. But how will it affect tax retributions and your overall pension fund?

As our digital connectivity and dependence become more prevalent, so too does the vulnerability to identity theft.

The workplace is not impervious either, making this threat a growing concern for employers mindful of their employees’ security.

In the search for solutions, identity theft insurance serves as a safety net for victims.

However, since this doesn’t prevent fraud from happening, an important question arises – is identity theft insurance worth it?

Identity theft involves stealing personally identifiable information (PII) and using it without permission, usually for deceit or fraud. This data includes anything from date of birth and a social security number to credit cards, medical accounts, and social media accounts.

The identity thief can get this information through a data breach, phishing scams, skimming devices, physical theft of personal belongings, and more.

When the perpetrator uses the stolen PII for illicit financial gains while posing as the victim, that’s called identity fraud.

Although identity theft can happen without identity fraud, these two are almost always correlated and are often used synonymously.

According to the Federal Trade Commission (FTC), in 2022, identity theft was reported 1,107,197 times, with credit card fraud being the main culprit. In fact, in 2022 alone, there were 440,672 reports of this type of threat.

The top-five category also included miscellaneous identity theft in second place with 326,511 reports, followed by bank fraud (156,143), loan or lease fraud (152,583), and employment or tax fraud (103,420).

While the data for 2023 is incomplete, the first three quarters show an improvement compared to the previous year.

However, a new issue has arisen.

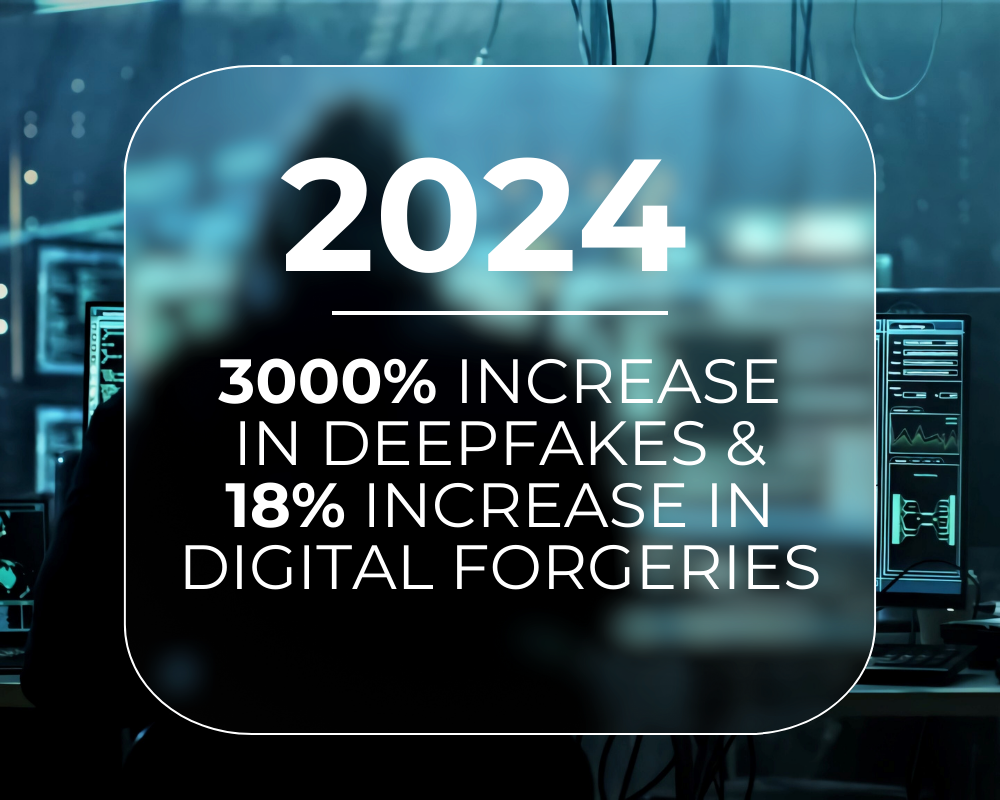

Onfido’s 2024 Identity Theft Report shows a 3000% increase in deepfakes and 18% more digital forgeries. This onset of AI and advanced digitalization opened new opportunities for scammers and fraudsters.

Thus, with such a high incidence of illicit activities, identity theft protection, especially insurance policies, has become a necessity.

But what is identity theft insurance exactly?

Identity theft insurance provides legal protection for victims of identity theft.

Although different insurers offer different coverage, the policy usually covers some of the costs associated with recovering from identity theft, for example, fees for identity restoration specialists, court hearings, and replacing documents.

This type of insurance doesn’t prevent identity infringement. Instead, it softens the financial blow to the victim.

As such, it’s a common feature of identity theft protection services.

Most insurance companies offer identity theft insurance, as well as some financial institutions and specialized identity theft protection services.

Considering the financial and emotional toll it can take on employees, employers, too, offer identity theft insurance as a standalone benefit or part of their legal insurance plans.

Apart from demonstrating a commitment to their employees, such benefits can make the company stand out when attracting new talent.

What identity theft insurance covers depends on the policy. However, most policies reimburse ID theft recovery expenses, including:

Identity theft insurance policies typically don’t cover stolen money or direct financial losses from fraud. They generally reimburse only for reporting and identity restoration costs.

However, a more comprehensive policy might offer identity or credit monitoring services, personal cyberattack coverage, and reimbursement for stolen funds from identity fraud.

Beyond what they offer, whether it’s simple coverage or extensive financial reimbursement, identity theft insurance policies can differ based on the policyholder and their structure.

If we look at who the insureds are, we have:

Sometimes, identity theft protection also comes as an endorsement to existing homeowners’ insurance policies and even renters’ insurance, allowing insureds to enhance their current coverage with identity theft protection.

When it comes to employer-provided insurance, the types further differentiate into:

Understanding the different types is crucial for individuals and businesses because choosing the right one depends on specific needs, the level of coverage needed, and the cost.

Whether it’s individual, family, or part of group insurance – these influence the cost, along with the provider and level of protection.

While it’s difficult to pinpoint the exact one, according to some sources, the insurance cost typically ranges between $25 and $60 per year.

In the event of an identity theft, insureds may need to pay an out-of-pocket deductible before receiving reimbursement for covered expenses. This deductible is similar to the concept in other types of insurance, where the policyholder contributes a certain amount before the insurance coverage takes effect.

Fee-based identity protection services, on the other hand, are more expensive.

This comprehensive protection that extends beyond insurance might cost between $10 and $30 per month.

Usually, the bigger the coverage, the more expensive the plan.

On a more positive note, since they usually offer monthly or yearly subscription options, the latter tends to be more affordable.

The market for ID theft protection could reach $28 billion by 2029.

In the wake of Identity Theft Awareness Week, it’s reassuring to know that there’s a growing awareness and an increased use of protection measures in recent years, insurance being one of them.

So, to answer the question – is identity theft insurance worth it?

In essence, yes.

However, there are factors to consider before opting in, including the risks, benefits, and long-term consequences.

Firstly, determine how significant the risk is.

Factors such as the nature of online activities, the extent of personal information shared, and the prevalence of identity theft contribute to the overall risk.

Predictions for 2024 by the Identity Theft Resource Center (ITRC) highlight that the unprecedented number of data breaches in 2023 drive new levels of identity crimes in 2024. Moreover, they also predict an increase in AI-driven identity scams and the emotional toll on the victims.

A thorough evaluation sets the stage for informed decisions on whether additional protection is necessary.

Existing policies already offer some level of protection and can reduce costs.

For individuals, this includes any security protocols provided by financial institutions, credit monitoring services, and other safeguards already in place.

As for employers, their legal insurance coverage might already include identity theft. If it doesn’t, they should consider a standalone policy and coverage that works best for their employees.

It’s important to understand that identity theft isn’t merely a short-lived inconvenience, but one that can have long-term consequences, from damage to credit scores and financial losses to the emotional toll on victims.

In fact, a 2023 report by ITRC shows that 16% of victims reported thoughts of suicide, a number that has doubled since 2020.

In the workplace, its ripple effects usually manifest as heightened employee stress levels and decreased productivity.

Thus, there’s an urgent need for comprehensive measures to combat and prevent identity theft, addressing mental well-being just as much as the financial implications.

Estimated to be $43 billion in 2022, the cost of identity infringement shows the scope of an issue affecting millions of U.S. individuals.

Businesses are not immune either, as statistics show that the FBI’s Internet Crime Complaint Center received almost 22,000 business complaints with over $2.7 billion in losses.

On the other hand, by providing a safeguard, employers show a commitment that benefits existing employees, enhances retention, and appeals to top talent.

Ultimately, the verdict to invest in identity theft insurance boils down to balancing risks and benefits. This decision can also be strategic for employers since offering an extra layer of protection can have long-term benefits.

Between this and their moral obligation to protect the workforce, the answer to whether identity theft insurance is worth it becomes an easy one.

Content Writer at Shortlister

Browse our curated list of vendors to find the best solution for your needs.

Subscribe to our newsletter for the latest trends, expert tips, and workplace insights!

You can cash out 401(k) early while still working. But how will it affect tax retributions and your overall pension fund?

Could stock options be the decision that transforms your career into a life-changing investment opportunity?

Gain an understanding of buyer intent data and its benefits for marketing and sales teams. Learn how to leverage it to generate new, qualified leads and increase sales conversions.

Transform your organization’s productivity and profitability with these PEO insights that can revolutionize your HR strategies.

Used by most of the top employee benefits consultants in the US, Shortlister is where you can find, research and select HR and benefits vendors for your clients.

Shortlister helps you reach your ideal prospects. Claim your free account to control your message and receive employer, consultant and health plan leads.