In This Post:

Presenters:

Michael Sowa

Director of Strategic Partnerships

As we approach 2025, businesses face the pressing need to address financial wellness holistically. Among the most significant challenges is student loan debt—a $1.8 trillion issue that delays life milestones for millions of Americans.

At this Meet A Vendor webinar Michael Sowa, Director of Strategic Partnerships at Candidly highlighted cutting-edge strategies for tackling this financial burden, enhancing workplace benefits, and staying ahead in a rapidly evolving landscape.

About Candidly

For the average American, financial instability is the norm. Two in three workers live paycheck to paycheck, 43 million adults carry student loan debt (for which monthly payments average $400), and one in four have less than $1,000 in savings.

That’s where Candidly comes in. Candidly partners with leading employers, retirement recordkeepers, and financial services providers to deliver solutions that bring financial wellness, security, and wealth within reach — for everyone.

Founded in 2016, Candidly is today the leading provider of solutions for planning and paying for college, repaying student loan debt, and building emergency and retirement savings.

From self-guided tools that help users optimize their savings strategy and find lending offers, to solutions for sponsored workplace benefits like tax-advantaged tuition reimbursement and student loan repayment assistance, coaching services, student loan retirement match and emergency savings programs, Candidly is committed to addressing the full lifecycle of financial wellness needs while maximizing ROI for our partners and their clients.

To date, Candidly has helped its users get on track to save $1.8B in student loan debt and finish paying off their debt 200,000 years faster. Candidly has been recognized as the industry’s leading innovator with awards including:

- Fast Company’s Most Innovative List (2024)

- Best in Business, Financial Services (2024)

- Forbes Fintech 50 (2023)

- Fintech Breakthrough Awards Best Student Loan Management Platform (2023, 2024

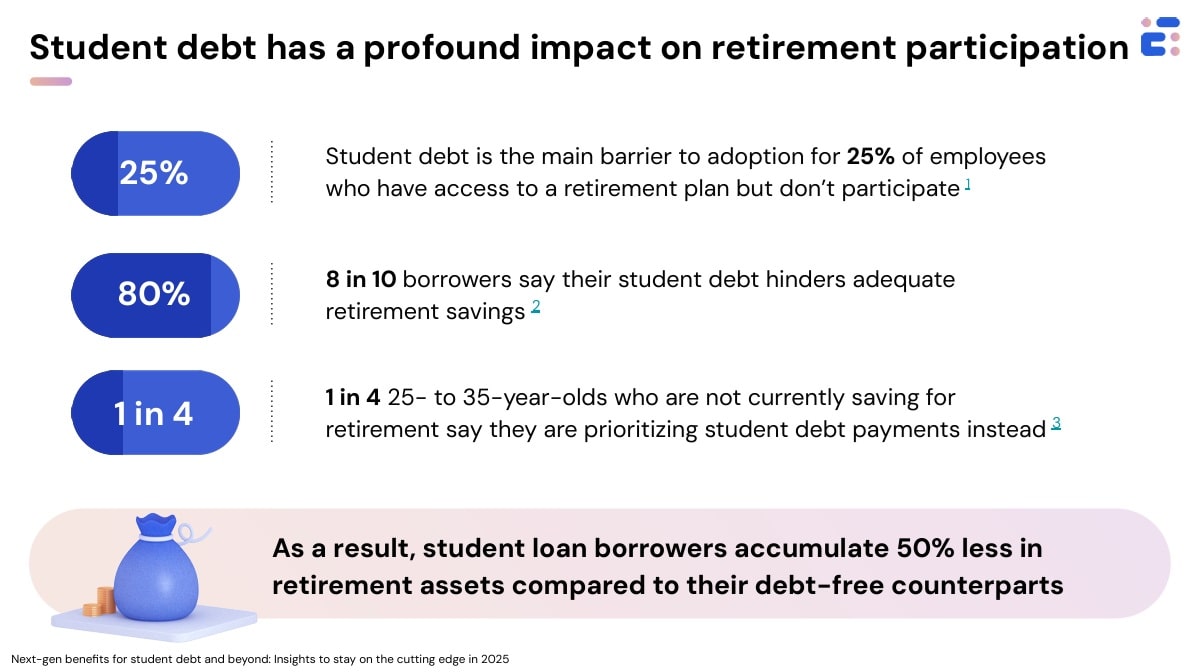

Student debt is a universal problem

Education should help people move forward. But for far too many of the 43 million Americans with student loan debt, going to college has resulted in a financial burden that takes decades to repay — and in the meantime, locks borrowers in a state of constant stress that holds them back from achieving their financial, personal, and professional goals.

In the workplace, that stress translates to lackluster engagement, lower productivity, and higher turnover.

Providing solutions for student debt isn’t just about helping employees — it’s about positioning brokers as thought leaders and helping clients take a strategic approach to achieving their business objectives. And in doing so, brokers can:

- Stand out in the market: Meet the moment for clients by being responsive to today’s biggest demands in the market.

- Win new business: Capture new business while winning long-term loyalty from existing clients with an in-demand, differentiated offering.

- Add value: Serve as an informed, subject matter expert when engaging with your clients.

Emerging workplace benefits for 2025

The modern workforce places high value on their employer’s benefit offerings: a recent survey found that more than 3 in 5 employees would consider leaving their job for an employer that provides more robust benefits, even if doing so resulted in a paycut. (Source: Employees prioritize benefits over pay, study finds).

With student loan perks ranking as the second most in-demand benefit among employees under 45 (Source: Employees prioritize benefits over pay, study finds), more employers are stepping up to deliver — and seeing the results. In fact, Candidly reports that employer clients that offer their student loan employer contribution solution see a 67% average reduction in likelihood of turnover among eligible employees.

And the positive impacts for employers don’t stop at improved retention. Offering student loan benefits helps employers:

- Tap into tax incentives. Per Section 127 of the IRC, employers can contribute up to $5,250 to employees’ student loan repayment, tax-free. And thanks to the SECURE Act 2.0, employers can match employees’ student loan payments with tax-advantaged retirement contributions.

- Promote workplace inclusivity. Because women and people of color are disproportionately impacted by student loan debt, this workplace benefit is an important opportunity for employers to improve the reach and accessibility of their financial wellness offerings.

- Streamlined, efficient vendor management. In addition to student loan benefits like employer contributions, matched retirement contributions, and coaching services, Candidly provides solutions for emergency savings, tuition reimbursement, and college savings.

A holistic approach

Candidly empowers employers to offer next-gen benefits for every stage of employee financial wellbeing by providing best-in-class solutions that help employees:

- Plan for college, including offerings for tuition reimbursement and tools for finding 529 college savings plans and private student loan offers

- Repay student debt, including offerings for student loan employer contributions, student loan coaching services, Public Service Loan Forgiveness support, and self-guided repayment optimization tools

- Build savings, including offerings for SECURE 2.0-enabled student loan retirement matching and matched emergency savings contributions

Get in touch with Candidly!

Candidly enables brokers to provide employer clients — of all sizes, and across all industries — with benefit solutions that strengthen engagement, supercharge retention, and build a more inclusive, holistic workplace wellness. To learn more, visit getcandidly.com or contact sales@getcandidly.com.

In case you missed it: Log in to access the full Meet A Vendor Presentation!

Not a subscriber? Request access.

Did you find this article interesting?

Don’t keep this knowledge to yourself – share it on your social media channels and spark engaging conversations!