In This Post:

Presenters:

Hans Dellenbach

VP Employee Benefits Channel Leader

In today’s evolving benefits landscape, brokers face increasing challenges to meet client demands for innovative and impactful solutions. The employee benefits landscape is undergoing a dramatic shift with financial security becoming a top priority for employees. As financial stress continues to affect workplace productivity and employee retention, brokers must step up to deliver tailored solutions that address these pressing challenges. They have a unique opportunity to position themselves as trusted partners by offering high-value benefits that address pressing concerns.

IDIQ is at the forefront of this transformation, offering innovative tools and resources that empower brokers to drive value, foster loyalty, and expand their business. On our last “Meet a Vendor” webinar we had the opportunity to gain exclusive insights into the future of financial intelligence, and stay ahead in a competitive market with Hans Dellenbach, VP Employee Benefits Channel Leader at IDIQ who leads the development of strategic partnerships with brokers to deliver personal cyber security and financial intelligence solutions for employer benefit programs.

Introducing IDIQ: A Partner in Financial Intelligence

IDIQ offers a robust suite of solutions that simplify access to financial resources, protect against identity theft, and support legal needs. With over 15 years of expertise and more than 4 million members protected with a network of over 30,000 strategic partners, IDIQ is revolutionizing financial benefits.

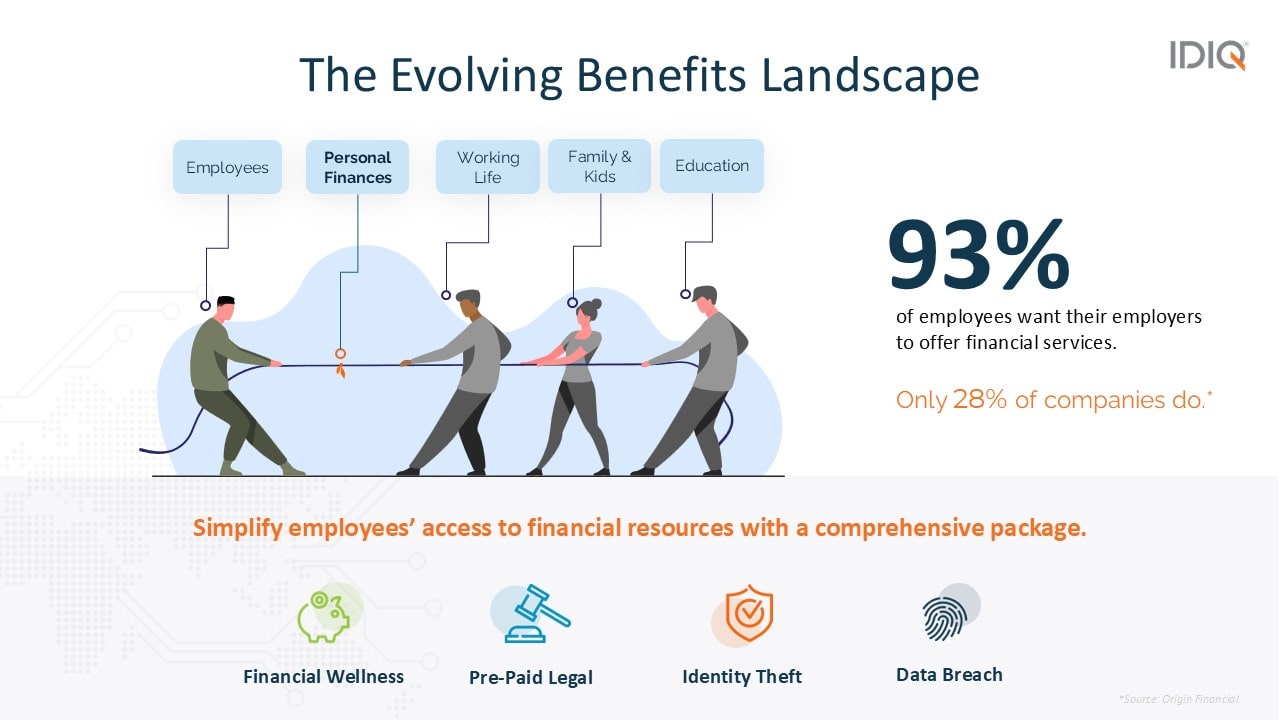

By simplifying employees’ access to financial resources through innovative platforms, IDIQ equips brokers with the tools to address key client concerns, including:

- Financial Security: IDIQ’s offerings go beyond traditional benefits, providing employees with a wide range of tools and resources, including:

- Personal Money Management: Budgeting tools, personalized financial alerts, and access to student loan refinancing options.

- Debt Resolution Support: Certified financial coaching to help employees tackle debt and make smarter financial decisions.

- Credit Resources: Real-time credit monitoring, fraud alerts, and recommendations for improving credit scores.

- Identity Theft Protection: Employees are increasingly concerned about protecting their personal information. IDIQ provides:

- Real-time fraud and Social Security Number (SSN) alerts.

- Three-bureau credit monitoring with detailed reports and scores.

- Up to $1 million in identity theft insurance.

- Antivirus, password management, and VPN services.

- Pre-Paid Legal Solutions: Legal challenges can be overwhelming, and IDIQ offers employees access to affordable and reliable legal services, such as:

- DIY legal document creation, including simple wills and medical powers of attorney.

- Consultations, advice, and discounted rates on legal matters.

- Representation through phone calls and legal letters.

These offerings not only enhance employee well-being but also position brokers as forward-thinking advisors.

The Growing Demand for Financial Wellness Solutions

Employees today are vocal about their need for financial wellness support. Recent studies highlight a significant gap between employee expectations and employer offerings in financial wellness. A staggering 93% of employees want their employers to provide financial services, yet only 28% of companies currently do so. This unmet need creates a valuable opportunity for brokers to introduce tailored solutions that enhance employee satisfaction and drive business growth.

Financial stress not only impacts employees’ personal lives but also their professional performance. Studies show that reduced financial stress leads to increased focus, productivity, and workplace satisfaction. By offering comprehensive financial wellness programs, brokers can provide employers with tools to create healthier, more engaged workforces while simultaneously enhancing their value as advisors.

Opportunities for Brokers

Why brokers should embrace IDIQ’s Solutions? As the workplace evolves, brokers face increasing pressure to differentiate themselves in a competitive market. By partnering with IDIQ, brokers can gain a competitive edge while addressing critical client needs and add tangible value to their services. Key benefits include:

- Elevated Client Relationships: Providing solutions that tackle employees’ financial and legal concerns enhances the value brokers bring to their clients. This builds trust and positions brokers as indispensable advisors.

- Increased Revenue: High-impact services such as financial coaching and identity protection not only meet client demands but also generate additional revenue streams for brokers. These in-demand offerings drive commission growth and create opportunities for long-term financial success.

- Business Growth: IDIQ helps brokers expand their portfolio with innovative benefits that attract new clients and retain existing ones. This establishes brokers as leaders in the benefits space and enables them to grow their book of business.

Tangible Benefits for Employers and Employees

The benefits of IDIQ’s solutions extend beyond brokers to employers and their teams. Organizations that offer financial wellness programs often experience:

- Higher Employee Retention: Financially secure employees are more likely to remain loyal to their employers.

- Improved Productivity: Reduced financial stress allows employees to focus better at work, boosting overall performance.

- Enhanced Workplace Culture: Empowered employees contribute to a positive and supportive environment.

- Stronger Employee Engagement: Accessible and valuable benefits encourage employees to take full advantage of what their employer offers.

As the demand for financial wellness programs grows, brokers must stay ahead of emerging trends. By partnering with IDIQ, brokers can deliver the solutions employees value most while helping employers achieve their workforce goals. IDIQ’s platform makes it easy for brokers to address their clients’ evolving needs through:

- Personalized financial coaching by certified experts.

- Advanced tools like debt simulators and credit score simulations.

- A comprehensive approach that integrates financial, identity, and legal support.

The more solutions brokers provide, the more value they add to their clients. This not only fosters stronger relationships but also creates a pathway for sustained revenue growth

As financial stress diminishes, workplace culture thrives, creating a win-win scenario for both employees and organizations.

The IDIQ platform is designed to make financial wellness accessible and impactful. From personalized coaching with certified experts to cutting-edge fraud protection and legal resources, IDIQ delivers value on every front. By embracing these solutions, brokers can establish leadership in the benefits space and secure long-term success.

Get in touch with IDIQ!

For brokers ready to elevate their offerings, IDIQ provides the tools and insights needed to succeed in a rapidly changing market. With its focus on empowering employees, reducing financial stress, and enhancing productivity, IDIQ helps brokers stand out and build lasting partnerships.

Contact IDIQ to learn more about how you can grow your business with IDIQ’s cutting-edge solutions. Don’t wait—join the movement toward smarter, more impactful financial benefits today.

Hans Dellenbach – HDellenbach@idiq.com

Darryl Freni – DFreni@idiq.com

Angelica Giger – AGiger@idiq.com

Jerry Kopydlowski – GKopydlowski@idiq.com

Mark Churchill – Mchurchill@idiq.com

In case you missed it: Log in to access the full Meet A Vendor Presentation!

Not a subscriber? Request access.

Did you find this article interesting?

Don’t keep this knowledge to yourself – share it on your social media channels and spark engaging conversations!