Presenters:

Hans Dellenbach

VP Employee Benefits Channel Leader

One crucial component of employee benefits is financial wellness. Yet organizations often overlook this aspect of workplace support as they navigate the evolving benefits landscape. Offering comprehensive financial security solutions can help attract, retain, and empower employees.

At this Meet A Vendor webinar, Hans Dellenbach, VP Employee Benefits Channel Leader at IDIQ, shares the latest insights from IDIQ’s Q1 2025 open enrollment data. We enjoyed hearing how companies can maximize employee financial wellness while driving business growth.

About IDIQ

IDIQ is a financial intelligence company that guides action to protect and strengthen people’s long-term financial health. They are at the forefront of this transformation by offering resources that empower brokers to drive value, foster loyalty, and expand their business. Provide peace of mind by utilizing powerful and innovative digital tools to actively monitor and protect the members’ identity protection and credit status.

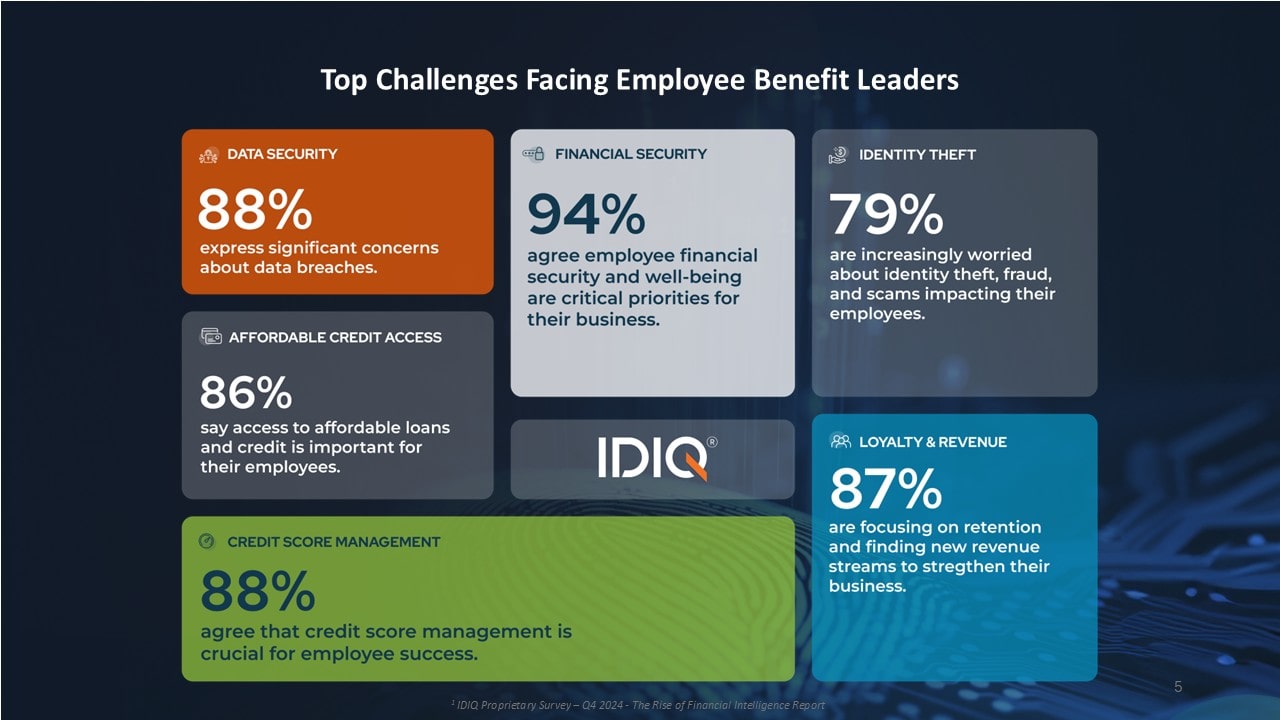

Today, employees seek more than traditional health benefits. Some benefits are key when it is taken into consideration. They come in a package of financial wellness, identity theft protection, and legal support. A recent proprietary survey conducted by IDIQ in Q4 2024—The Rise of Financial Intelligence Report—highlights some of the top challenges facing employee benefits leaders:

- Financial Stress: Struggling with financial burdens impacts productivity and job satisfaction for every employee.

- Holistic Benefits: Employees seek proactive financial security solutions. Health insurance is no longer sufficient.

- Simplicity: Simplified access to financial resources encourages higher participation rates in voluntary benefits.

IDIQ Key Insights from Q1 2025

IDIQ’s recent open enrollment data showcases critical trends in employee preferences:

- Plan Selections:

- Identity Theft Protection: 61% opted in.

- Pre-Paid Legal Services: 71% opted in.

- Financial Wellness Plans: 40% opted in.

- Number of Plans Selected:

- 56% of members chose one plan.

- 28% opted for two plans.

- 21% selected all three available plans.

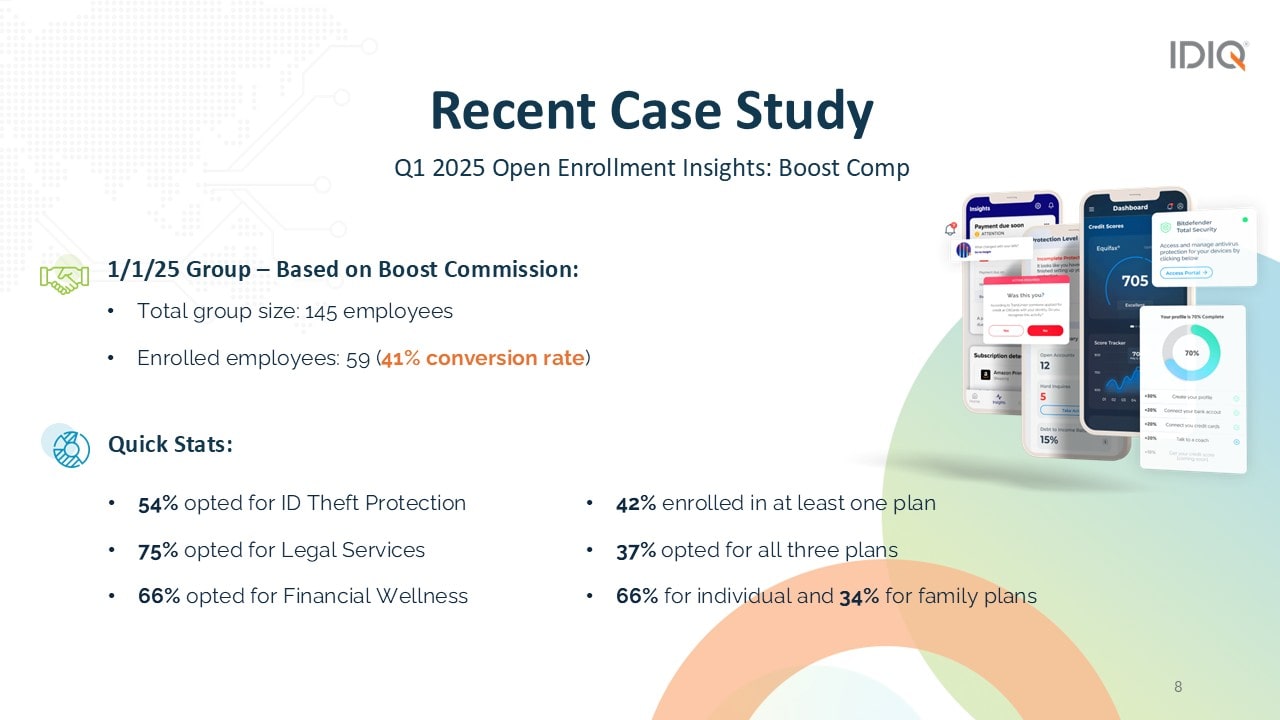

A recent case study from a company with 145 employees showed a 41% enrollment conversion rate, with notable adoption rates:

- 54% chose ID Theft Protection.

- 75% opted for Legal Services.

- 66% enrolled in Financial Wellness plans.

- 37% of employees selected all three available plans.

Offering financial wellness benefits directly impacts employee productivity, satisfaction, and retention. Key advantages include:

- Increased Employee Productivity – Employees facing financial stress are more likely to experience distractions at work. Providing financial security benefits can improve focus and performance.

- Higher Employee Retention – Competitive benefits encourage long-term loyalty and engagement.

- Stronger Workplace Culture – A workforce that feels financially secure makes better financial decisions.

Opportunities for Brokers and Employers

The demand for financial security solutions presents a strategic opportunity for brokers and HR leaders. Differentiating with unique solutions addresses client concerns by offering tangible benefits that improve financial well-being.

Financial security increases earnings potential, deepens client relationships, and drives commission growth.

Expand the organization’s portfolio and elevate offerings with innovative financial wellness plans that establish your leadership in the benefits space.

Get in touch with IDIQ!

As financial challenges continue to impact employees, organizations must proactively support their workforce with robust financial wellness benefits. IDIQ’s platform simplifies access to identity theft protection, legal services, and financial wellness solutions—empowering employees to secure their financial future.

By integrating these offerings, businesses can elevate employee well-being, drive engagement, and foster a culture of financial intelligence that benefits both employees and the organization. Contact IDIQ to learn more about how you can grow your business with IDIQ’s cutting-edge solutions.

For more insights and tailored financial wellness solutions, explore IDIQ’s offerings today!

For more information, contact:

Hans Dellenbach – HDellenbach@idiq.com

Darryl Freni – DFreni@idiq.com

Angelica Giger – AGiger@idiq.com

Jerry Kopydlowski – GKopydlowski@idiq.com

Mark Churchill – Mchurchill@idiq.com

Matt Salge – MSalge@idiq.com

In case you missed it: Log in to access the full Meet A Vendor Presentation!

Not a subscriber? Request access.

Did you find this article interesting?

Don’t keep this knowledge to yourself – share it on your social media channels and spark engaging conversations!