In This Post:

Presenters:

Julia Fearn

Director of Channel Partnerships at SoFi at Work

Today’s financial landscape is complex, and for many employees, the burden of student loans adds considerable strain. To help employers ease these financial challenges, for the past decade SoFi at Work has been providing solutions that help companies empower their employees’ financial wellbeing through personalized and effective student loan benefits.

Last week, on our Meet a Vendor webinar series we had the pleasure to hear from SoFi at Work their solutions. Led by Julia Fearn, Director of Channel Partnerships at SoFi at Work, the mission is clear: to provide employers with powerful tools to relieve financial stress for employees and help them thrive in their financial journey.

Financial wellbeing is the

leading area of investment for 2024

Understanding the Importance of Financial Wellbeing

Financial wellbeing is one of the top priorities for companies investing in employee benefits in 2024. Rising debt, insufficient emergency savings, and financial anxiety directly impact employee satisfaction and productivity. Research shows:

- 60% of full-time employees are stressed about finances

- 56% spending over three hours a week at work on personal financial issues.

- Nearly 36% of financially stressed employees are looking for new jobs, indicating a clear need for companies to support financial wellness to retain top talent.

Source: PWC, 2023 Employee Financial Wellness Survey

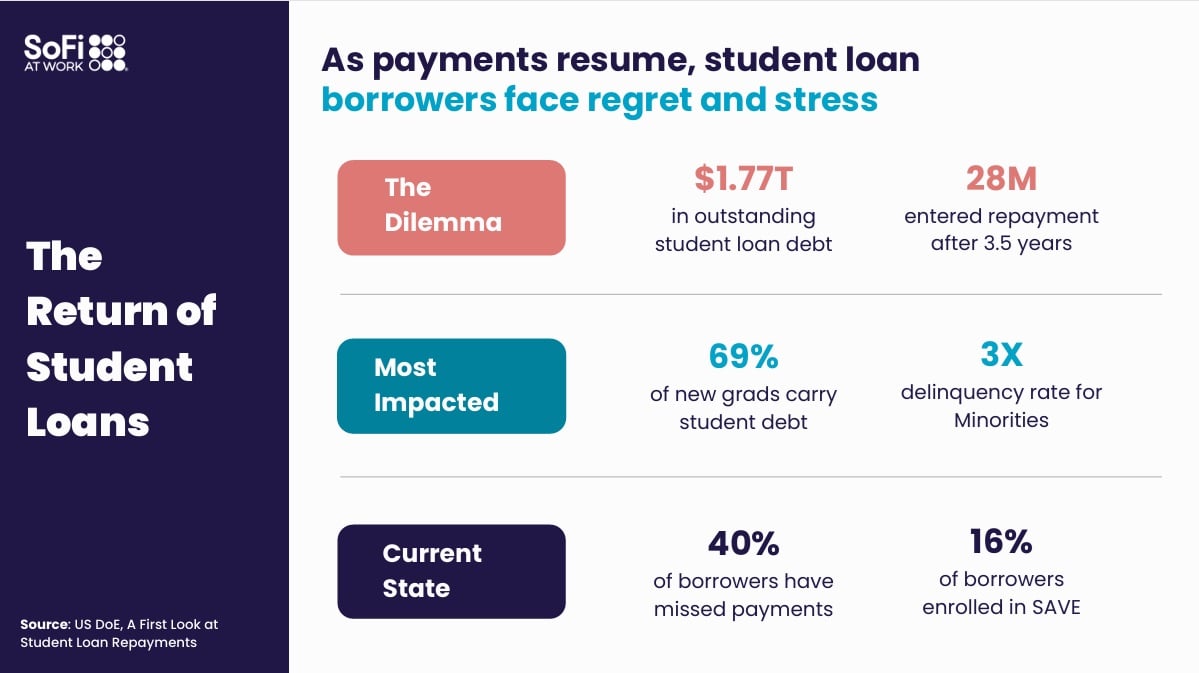

The Student Loan Landscape: A Persistent Challenge

Student loan debt stands at an astounding $1.77 trillion, affecting 69% of new graduates and posing significant challenges, particularly for underrepresented groups. After a pause, repayment has resumed for 28 million borrowers, with 40% having missed payments already. Employers play a vital role in helping alleviate this financial strain through strategic benefit offerings.

Why SoFi at Work Stands Out

Sofi at Work has been at the forefront of innovation in the student loan space for the better part of a decade. Their early adoption of the Student Loan Verification for SECURE Act 2.0 further demonstrated their commitment to modernizing how employers help their employees thrive financially.

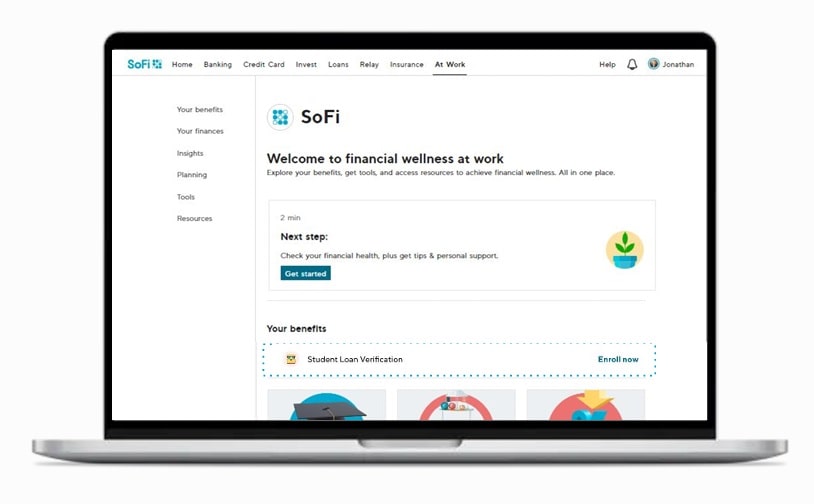

SoFi at Work has partnered with over 1,100 companies, including seven of the top Fortune 500, to deliver an education-first approach that meets employees’ financial needs from education through retirement. The SoFi at Work Dashboard gives employees easy access to tools and resources tailored to their unique financial situations, including:

- Student Loan Contribution Programs: SoFi at Work offers customized student loan contributions, attracting top talent by helping employees pay down debt and providing an opportunity for companies to directly support their employees’ financial health. You can read more here.

- Tuition Reimbursement Management: Efficiently manages tuition reimbursement, reducing administrative burdens and ensuring timely, accurate payments for employees.

- Student Loan 401(k) Match: An innovative solution to allow employees to save for retirement while paying down student loans, providing long-term financial security. Read more here.

The SoFi Advantage: Financial Strength, Expertise, and Resources

SoFi at Work’s platform integrates industry-leading financial tools with personalized support from certified financial planners. Through SoFi’s solutions, employees can monitor their financial status by connecting both SoFi and external accounts, while benefiting from exclusive discounts and financial education resources. This support strengthens their path toward achieving financial independence and peace of mind.

Partnership Benefits: The Future of Employee Financial Wellbeing

By partnering with SoFi, employers gain a competitive edge in the talent market by offering benefits that actively contribute to employees’ financial health. Employers can access a streamlined dashboard where employees can enroll with ease, and exclusive discounts make SoFi’s high-quality financial products even more accessible. Moreover, employees gain access to personalized financial tools, certified financial planners, and ongoing educational content—all reinforcing the company’s commitment to supporting them every step of the way.

Taking Financial Wellbeing to the Next Level

From helping with student loan debt to planning for retirement, SoFi at Work has redefined employee financial wellbeing with tailored solutions that address immediate and long-term financial needs. As financial challenges evolve, SoFi at Work continues to innovate and adapt, offering companies solutions that are both effective and empowering.

Get in touch with the SoFi Team today!

Ready to explore how SoFi at Work can make a difference for your employees? Discover innovative solutions and empower your team’s financial future today.

Reach out SoFi’s dedicated team today.

Julia Fearn – jfearn@sofi.com

In case you missed it: Log in to access the full Meet A Vendor Presentation!

Not a subscriber? Request access.

Did you find this article interesting?

Don’t keep this knowledge to yourself – share it on your social media channels and spark engaging conversations!