Infographic: Buy Now Pay Later Statistics

Discover the growing trend of consumers utilizing BNPL services to pay for purchases.

The last few decades have shown us that startups have tremendous potential. They contribute billions of dollars to the global economy and create many job opportunities. From Amazon to Apple, they are the driving force behind innovation and new technology. And these recent startup statistics show their importance as economic growth leaders.

Even amid the COVID-19 pandemic, these companies held their positions and played a significant role in the economic recovery, showing they are necessary for economic resiliency and job growth.

And after a decade of an entrepreneurial recession, the U.S. experienced a startup boom during the pandemic. There was notable growth in healthcare and retail, which came as no surprise after the e-commerce expansion.

In other words, the innovation revolution didn’t stop when the world did. That goes on to show that they are a force on their own.

Instead of following, startups create trends.

They initiate their own company culture that focuses on individual contributions to a mutual goal of creating something meaningful and unique. Thus, their workforce planning engages an array of skills and personalities.

Most of the time, startups strive toward shared values and beliefs and create a workplace with a strong sense of accomplishment. In fact, these companies are great for gaining diverse employee experience, and they keep the workforce much more competitive.

Let’s see what other startup trends marked the past few years and how big they made an impact.

While some industries struggled with the negative impacts of COVID-19, fintech experienced a financial boom. Its convenience, effectiveness, and low-cost products made it an attractive investment opportunity.

As a result, fintech startups reached several milestones, and experts predict an additional 20% growth over the next four years.

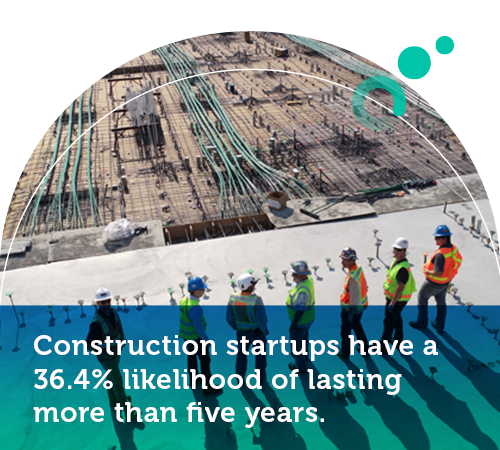

When it comes to startups, construction is often overlooked. Even though it’s the second least digitized industry after agriculture.

However, it’s worth mentioning that this industry accounts for 13% of the global G.D.P. So, merging the “old with the new” has massive innovation potential.

Contech startups are leading the revolution, and these startup statistics give you an overview of this industry’s extent.

The technological renaissance affected the real estate industry as much as any other. Real estate startups or PropTech startups gained momentum in 2021.

By digitally transforming the property industry, proptech startups introduced new tools, reshaped property buying, and reduced paperwork. So, it comes as no surprise that they are now gaining the attention of investors.

Launching a startup and surviving in such a competitive market takes a lot of work. Founders must create a sustainable business model. They need to find their business niche, meet the market demand for their product or service, and secure a steady cash flow.

Despite all this, startups can still fail, thus their notorious failure rate.

It’s also one of the reasons why investors deem them “unstable.” Although a valid point to some extent, these startup failure statistics show why and how startups fail.Understanding them can help startup founders avoid common mistakes, thus giving them an advantage in the right market.

According to the latest startup industry statistics, technology is leading the change. Many new industries were created by startups merging technology with existing business models. They’re showing significant growth worldwide and are set to expand even more.

It’s a little-known fact that three startups have reached the $100 billion mark. The same goes for the gender gap between startup founders. In fact, these startup business statistics show that female founders hold less than a quarter of all new ventures and are less likely to get investments.

The startup market is very competitive, so the early stages of funding can either make or break a business.

Most startup owners rely on savings to launch a business. However, as demand grows, so does the need for further expansion and funding.

The startup funding statistics give an insight into external funding. Furthermore, these startup statistics unveil how long it takes to switch between funding rounds, which industries get the biggest slice of the pie, and what investors are focusing on right now.

For years now, startups have been transforming society. These ideas turned into billion-dollar companies and are the driving forces of the economy. They offer solutions, give a new perspective on pressing matters, and create opportunities.

The startup statistics above show that startups can move the world forward with the right combination of a sound business plan, the right B.P.O., and a little bit of luck.

Browse our curated list of vendors to find the best solution for your needs.

Subscribe to our newsletter for the latest trends, expert tips, and workplace insights!

Discover the growing trend of consumers utilizing BNPL services to pay for purchases.

Understanding the pros and cons of using 401(k) as a first-time home buyer is crucial. Should using the 401(k) as a first-time home

buyer be considered as a last resort?

You can cash out 401(k) early while still working. But how will it affect tax retributions and your overall pension fund?

Optimize your 401(k) strategies with key insights for companies and employees, ensuring a secure financial future for all stakeholders.

Used by most of the top employee benefits consultants in the US, Shortlister is where you can find, research and select HR and benefits vendors for your clients.

Shortlister helps you reach your ideal prospects. Claim your free account to control your message and receive employer, consultant and health plan leads.